Think of a blockchain as a digital ledger or record book that stores information across a network of computers. Each block in the chain contains a list of transactions, and every time a new transaction occurs, it’s added to the chain as a new block.

What makes blockchain special is that once information is added to the chain, it’s very difficult to change or tamper with because each block contains a unique code called a cryptographic hash, and it references the previous block’s hash. This creates a chain of blocks that are linked together, hence the name “blockchain.”

So, blockchain technology allows for secure, transparent, and decentralized record-keeping of transactions without the need for a central authority like a bank. It’s often associated with cryptocurrencies like Bitcoin, but its applications extend far beyond just digital currencies, including supply chain management, voting systems, and more.

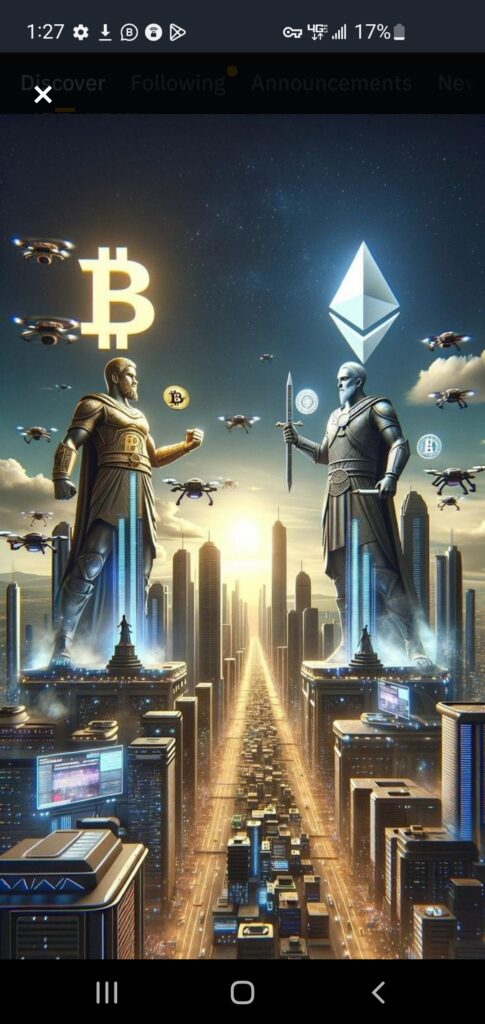

Bitcoin and Ethereum are both cryptocurrencies, but they have some fundamental differences:

BTC vs ETH

Purpose: Bitcoin was created as a digital currency for peer-to-peer transactions, aiming to become a decentralized alternative to traditional currencies. Ethereum, on the other hand, was designed as a platform for building decentralized applications (DApps) and smart contracts. While Ether (Ethereum’s native cryptocurrency) can be used for transactions, the primary focus of Ethereum is on enabling developers to create and deploy decentralized applications.

Technology: Bitcoin uses a blockchain primarily for recording transactions. Ethereum also uses a blockchain, but it’s more flexible and allows developers to create smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This enables a wider range of applications beyond simple transactions, such as decentralized finance (DeFi), decentralized autonomous organizations (DAOs), and more.

Consensus Mechanism: Bitcoin uses the proof-of-work (PoW) consensus mechanism, where miners compete to solve complex mathematical puzzles to validate transactions and create new blocks. Ethereum currently uses a similar PoW mechanism, but it’s transitioning to proof-of-stake (PoS) with Ethereum 2.0, where validators are chosen to create new blocks based on the amount of cryptocurrency they hold and are willing to “stake” as collateral.

Supply Limit: Bitcoin has a maximum supply cap of 21 million coins, making it a deflationary asset. Ethereum does not have a hard cap on its supply, but the issuance rate is currently capped at a certain amount per year. However, there are ongoing discussions within the Ethereum community about potential changes to the supply dynamics.

Community and Ecosystem: Both Bitcoin and Ethereum have large and active communities, but they tend to focus on different aspects. Bitcoin’s community is often more focused on its role as a digital store of value and a hedge against traditional financial systems, while Ethereum’s community is more diverse and includes developers, entrepreneurs, and enthusiasts interested in building and using decentralized applications.

Overall, while Bitcoin and Ethereum are both cryptocurrencies, they serve different purposes and have different technological designs, consensus mechanisms, and communities supporting them.

Decentralized Finance, often abbreviated as DeFi, refers to a set of financial services and applications built on blockchain technology that operate without traditional intermediaries like banks or brokerages. Instead, DeFi relies on smart contracts and decentralized networks, typically on platforms like Ethereum, to facilitate various financial activities. Here are some key aspects of DeFi:

Decentralization: DeFi aims to remove central points of control, such as banks or financial institutions, and instead relies on decentralized networks of computers to execute and verify transactions. This increases transparency and reduces the need for trust in third parties.

Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. In DeFi, smart contracts automate and enforce the rules of financial agreements, eliminating the need for intermediaries like lawyers or escrow agents.

Lending and Borrowing: DeFi platforms allow users to lend or borrow digital assets without the need for a traditional bank. Through protocols like decentralized lending platforms, users can earn interest by lending out their cryptocurrency holdings or borrow assets by providing collateral.

Decentralized Exchanges (DEXs): DEXs are platforms that facilitate peer-to-peer trading of cryptocurrencies without the need for intermediaries. These exchanges operate using smart contracts to execute trades directly between users, providing greater privacy and control over assets.

Stablecoins: Stablecoins are cryptocurrencies that are pegged to the value of traditional fiat currencies like the US dollar or assets like gold. DeFi platforms often use stablecoins as a means of exchange and store of value within their ecosystems, providing stability compared to the volatility of other cryptocurrencies.

Derivatives and Asset Management: DeFi also includes platforms for trading derivatives, such as options and futures contracts, as well as asset management protocols that enable users to invest in various financial products and strategies in a decentralized manner.

Overall, DeFi aims to democratize access to financial services, increase financial inclusion, and reduce reliance on centralized institutions by leveraging blockchain technology and decentralized networks. However, it’s important to note that DeFi platforms are still relatively new and experimental, and users should exercise caution and do their own research before participating in DeFi activities.

lyfp03

b2u79f

62lyqt

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

You really make it seem so easy with your presentation but I to find this topic to be actually one thing

which I believe I’d never understand. It kind of feels too complex and extremely large for

me. I’m having a look ahead on your next submit, I will try to get the grasp of it!

Lista escape roomów

You have remarked very interesting details!

ps decent site.!

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Aw, this was an incredibly nice post. Spending some time and actual effort to generate a great article… but what can I say… I hesitate a whole lot and don’t manage to get nearly anything done.

The next time I read a blog, Hopefully it won’t fail me just as much as this particular one. I mean, Yes, it was my choice to read, but I actually thought you’d have something useful to say. All I hear is a bunch of crying about something that you can fix if you were not too busy looking for attention.

An outstanding share! I have just forwarded this onto a coworker who was doing a little homework on this. And he actually ordered me lunch simply because I stumbled upon it for him… lol. So let me reword this…. Thanks for the meal!! But yeah, thanks for spending time to talk about this subject here on your site.

Great blog you have here.. It’s hard to find quality writing like yours nowadays. I seriously appreciate individuals like you! Take care!!

I like it whenever people come together and share ideas. Great website, keep it up.

It’s hard to find well-informed people in this particular topic, but you seem like you know what you’re talking about! Thanks

Greetings! Very helpful advice in this particular article! It’s the little changes that produce the largest changes. Thanks a lot for sharing!

I seriously love your website.. Excellent colors & theme. Did you make this site yourself? Please reply back as I’m attempting to create my very own blog and would like to find out where you got this from or exactly what the theme is named. Cheers!

Oh my goodness! Incredible article dude! Many thanks, However I am having problems with your RSS. I don’t know why I can’t subscribe to it. Is there anybody else getting similar RSS problems? Anybody who knows the answer will you kindly respond? Thanx.

Hi there! I just want to give you a big thumbs up for your great info you have got right here on this post. I am returning to your site for more soon.

After looking into a number of the blog posts on your web site, I truly appreciate your technique of writing a blog. I book marked it to my bookmark site list and will be checking back soon. Please visit my website too and tell me what you think.

An outstanding share! I’ve just forwarded this onto a colleague who was doing a little research on this. And he in fact bought me breakfast due to the fact that I stumbled upon it for him… lol. So allow me to reword this…. Thank YOU for the meal!! But yeah, thanks for spending time to talk about this subject here on your web page.

Can I just say what a comfort to discover a person that truly understands what they’re discussing online. You definitely understand how to bring an issue to light and make it important. More and more people ought to look at this and understand this side of your story. I can’t believe you aren’t more popular given that you certainly have the gift.

bookmarked!!, I like your web site!