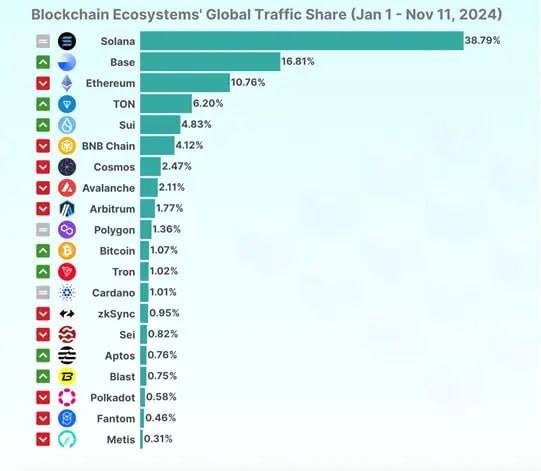

🗣Meme Coins Power Solana’s Dominance Solana remains the top blockchain for global traffic, driven by meme tokens. Base takes second place, while Ethereum falls to third with 10.8% of user activity. Analysts note Ethereum’s decline stems from fragmented interest across Layer 2 solutions.

Meme Coins Power Solana’s Dominance: A Deep Dive into Blockchain Traffi

Meme Coins Power Solana’s Dominance: A Deep Dive into Blockchain Traffic Trends

The blockchain landscape is ever-evolving, with technological innovation and user adoption shaping its trajectory. Recently, Solana has emerged as the leading blockchain in terms of global traffic, driven significantly by the popularity of meme coins. This rise has positioned Solana as a major force in the industry, while Base has claimed the second spot, leaving Ethereum to fall to third place with just 10.8% of user activity. Analysts attribute Ethereum’s decline to fragmented interest across its Layer 2 solutions. But what does this mean for the blockchain ecosystem, and how has Solana leveraged meme tokens to reach this pinnacle?

Solana: The New Powerhouse

Solana’s ascension in the blockchain space is no accident. Known for its high-speed transactions and low fees, Solana has been a magnet for developers and users looking for a scalable blockchain solution. Its ability to process thousands of transactions per second has set it apart from competitors, making it a preferred choice for projects that demand efficiency.

What’s driving Solana’s dominance, however, is the rise of meme coins. These tokens, often created with lighthearted intentions or as internet jokes, have gained serious traction among crypto enthusiasts. Solana’s low transaction costs make it an ideal platform for trading meme coins, which often rely on high-frequency trading and large transaction volumes.

Tokens like Bonk, Cheems, and Samo have captured the imagination of the crypto community, leading to massive increases in transaction volume on Solana. Their popularity isn’t just a reflection of internet culture but also demonstrates the blockchain’s capability to handle viral trends without succumbing to network congestion.

Base: A Surprising Contender

Occupying the second spot in global blockchain traffic is Base, a Layer 2 blockchain built on Ethereum by Coinbase. Base has quickly risen in popularity due to its user-friendly ecosystem and strong backing from Coinbase, a major name in the crypto industry. While its infrastructure leverages Ethereum’s security, Base has successfully attracted users with faster transactions and lower fees.

Base’s ability to integrate seamlessly with Ethereum while offering improved scalability has made it a strong competitor. The blockchain has attracted both decentralized applications (dApps) and meme coin creators, who see it as a middle ground between Ethereum’s security and Solana’s speed.

Despite its achievements, Base still lags behind Solana, which enjoys a larger ecosystem and higher user engagement, thanks to its early adoption of meme tokens. However, Base’s rise is a clear indicator of growing competition in the Layer 2 space.

Ethereum: The Fragmented Giant

Ethereum, once the undisputed leader in blockchain traffic, has seen its dominance wane. Currently, it accounts for only 10.8% of global user activity, a stark contrast to its earlier days as the go-to blockchain for developers and users alike.

Analysts point to fragmentation as a key factor in Ethereum’s decline. The proliferation of Layer 2 solutions like Arbitrum, Optimism, and zkSync has divided Ethereum’s user base, spreading activity across multiple platforms. While these Layer 2 solutions improve scalability and reduce fees, they inadvertently dilute Ethereum’s overall traffic.

Moreover, Ethereum’s high transaction costs and slower processing speeds compared to newer blockchains have made it less appealing for certain use cases, particularly meme coins. Many users prefer platforms like Solana and Base for trading meme tokens, leaving Ethereum with less traffic in this rapidly growing sector.

The Role of Meme Coins in Blockchain Popularity

Meme coins have proven to be more than just a passing trend in the crypto space. These tokens, which often start as humorous or satirical projects, have developed dedicated communities and significant market caps. Their success is driven by several factors:

- Community Engagement: Meme coins thrive on strong, active communities that drive adoption and trading volume. Platforms like Solana and Base have capitalized on this by providing the infrastructure needed to support these communities.

- Low Entry Barriers: The affordable transaction costs on Solana and Base make them attractive for meme coin creators and traders. In contrast, Ethereum’s high fees can be prohibitive for smaller projects and individual traders.

- Virality: Meme coins often go viral on social media platforms, attracting a wide audience of users who might not typically engage with crypto. This influx of new users benefits blockchains that can handle the increased traffic without compromising performance.

- Speculation: The volatile nature of meme coins attracts traders looking for high-risk, high-reward opportunities. This speculative activity contributes to increased transaction volumes on the blockchains that host these tokens.

Challenges and Opportunities Ahead

While Solana’s dominance is noteworthy, it also highlights broader trends and challenges within the blockchain space. The rise of meme coins, while beneficial in terms of traffic, raises questions about the sustainability of such growth. Critics argue that relying on meme tokens could make blockchains vulnerable to market volatility and trends that may not last long.

For Ethereum, the challenge lies in unifying its ecosystem and addressing the inefficiencies that have driven users to other platforms. With the Ethereum 2.0 upgrade and continued development of Layer 2 solutions, there is potential for the blockchain to regain its footing. However, this will require a strategic focus on reducing fees and improving user experience.

Base, on the other hand, must work to solidify its position as a Layer 2 solution while competing with Solana’s superior scalability and Ethereum’s established reputation. Its success will depend on how well it can attract developers and users from its larger competitors.

Conclusion

The current state of blockchain traffic underscores the dynamic nature of the crypto industry. Solana’s rise, powered by meme coins, reflects the importance of adaptability and innovation in capturing user interest. Base’s emergence as a strong contender shows that newer platforms can quickly carve out a space in the market, while Ethereum’s decline serves as a cautionary tale about the risks of fragmentation and high costs.

As meme coins continue to shape the blockchain landscape, it will be interesting to see how these trends evolve and whether Solana can maintain its dominance. The competition among blockchains is fierce, and the winners will be those that can balance scalability, affordability, and user engagement in a rapidly changing environment.

In the end, the blockchain ecosystem is far from static, and the race for dominance is an ongoing battle. Solana, Base, and Ethereum each have unique strengths and challenges, ensuring that the next phase of blockchain development will be as unpredictable as it is exciting.

c TrendsThe blockchain landscape is ever-evolving, with technological innovation and user adoption shaping its trajectory. Recently, Solana has emerged as the leading blockchain in terms of global traffic, driven significantly by the popularity of meme coins. This rise has positioned Solana as a major force in the industry, while Base has claimed the second spot, leaving Ethereum to fall to third place with just 10.8% of user activity. Analysts attribute Ethereum’s decline to fragmented interest across its Layer 2 solutions. But what does this mean for the blockchain ecosystem, and how has Solana leveraged meme tokens to reach this pinnacle?Solana: The New PowerhouseSolana’s ascension in the blockchain space is no accident. Known for its high-speed transactions and low fees, Solana has been a magnet for developers and users looking for a scalable blockchain solution. Its ability to process thousands of transactions per second has set it apart from competitors, making it a preferred choice for projects that demand efficiency.What’s driving Solana’s dominance, however, is the rise of meme coins. These tokens, often created with lighthearted intentions or as internet jokes, have gained serious traction among crypto enthusiasts. Solana’s low transaction costs make it an ideal platform for trading meme coins, which often rely on high-frequency trading and large transaction volumes.Tokens like Bonk, Cheems, and Samo have captured the imagination of the crypto community, leading to massive increases in transaction volume on Solana. Their popularity isn’t just a reflection of internet culture but also demonstrates the blockchain’s capability to handle viral trends without succumbing to network congestion.Base: A Surprising ContenderOccupying the second spot in global blockchain traffic is Base, a Layer 2 blockchain built on Ethereum by Coinbase. Base has quickly risen in popularity due to its user-friendly ecosystem and strong backing from Coinbase, a major name in the crypto industry. While its infrastructure leverages Ethereum’s security, Base has successfully attracted users with faster transactions and lower fees.Base’s ability to integrate seamlessly with Ethereum while offering improved scalability has made it a strong competitor. The blockchain has attracted both decentralized applications (dApps) and meme coin creators, who see it as a middle ground between Ethereum’s security and Solana’s speed.Despite its achievements, Base still lags behind Solana, which enjoys a larger ecosystem and higher user engagement, thanks to its early adoption of meme tokens. However, Base’s rise is a clear indicator of growing competition in the Layer 2 space.Ethereum: The Fragmented GiantEthereum, once the undisputed leader in blockchain traffic, has seen its dominance wane. Currently, it accounts for only 10.8% of global user activity, a stark contrast to its earlier days as the go-to blockchain for developers and users alike.Analysts point to fragmentation as a key factor in Ethereum’s decline. The proliferation of Layer 2 solutions like Arbitrum, Optimism, and zkSync has divided Ethereum’s user base, spreading activity across multiple platforms. While these Layer 2 solutions improve scalability and reduce fees, they inadvertently dilute Ethereum’s overall traffic.Moreover, Ethereum’s high transaction costs and slower processing speeds compared to newer blockchains have made it less appealing for certain use cases, particularly meme coins. Many users prefer platforms like Solana and Base for trading meme tokens, leaving Ethereum with less traffic in this rapidly growing sector.The Role of Meme Coins in Blockchain PopularityMeme coins have proven to be more than just a passing trend in the crypto space. These tokens, which often start as humorous or satirical projects, have developed dedicated communities and significant market caps. Their success is driven by several factors:1. Community Engagement: Meme coins thrive on strong, active communities that drive adoption and trading volume. Platforms like Solana and Base have capitalized on this by providing the infrastructure needed to support these communities.2. Low Entry Barriers: The affordable transaction costs on Solana and Base make them attractive for meme coin creators and traders. In contrast, Ethereum’s high fees can be prohibitive for smaller projects and individual traders.3. Virality: Meme coins often go viral on social media platforms, attracting a wide audience of users who might not typically engage with crypto. This influx of new users benefits blockchains that can handle the increased traffic without compromising performance.4. Speculation: The volatile nature of meme coins attracts traders looking for high-risk, high-reward opportunities. This speculative activity contributes to increased transaction volumes on the blockchains that host these tokens.Challenges and Opportunities AheadWhile Solana’s dominance is noteworthy, it also highlights broader trends and challenges within the blockchain space. The rise of meme coins, while beneficial in terms of traffic, raises questions about the sustainability of such growth. Critics argue that relying on meme tokens could make blockchains vulnerable to market volatility and trends that may not last long.For Ethereum, the challenge lies in unifying its ecosystem and addressing the inefficiencies that have driven users to other platforms. With the Ethereum 2.0 upgrade and continued development of Layer 2 solutions, there is potential for the blockchain to regain its footing. However, this will require a strategic focus on reducing fees and improving user experience.Base, on the other hand, must work to solidify its position as a Layer 2 solution while competing with Solana’s superior scalability and Ethereum’s established reputation. Its success will depend on how well it can attract developers and users from its larger competitors.ConclusionThe current state of blockchain traffic underscores the dynamic nature of the crypto industry. Solana’s rise, powered by meme coins, reflects the importance of adaptability and innovation in capturing user interest. Base’s emergence as a strong contender shows that newer platforms can quickly carve out a space in the market, while Ethereum’s decline serves as a cautionary tale about the risks of fragmentation and high costs.As meme coins continue to shape the blockchain landscape, it will be interesting to see how these trends evolve and whether Solana can maintain its dominance. The competition among blockchains is fierce, and the winners will be those that can balance scalability, affordability, and user engagement in a rapidly changing environment.In the end, the blockchain ecosystem is far from static, and the race for dominance is an ongoing battle. Solana, Base, and Ethereum each have unique strengths and challenges, ensuring that the next phase of blockchain development will be as unpredictable as it is exciting.

Meme Coins Power Solana’s Dominance: A Deep Dive into Blockchain Traffic Trends

The blockchain landscape is ever-evolving, with technological innovation and user adoption shaping its trajectory. Recently, Solana has emerged as the leading blockchain in terms of global traffic, driven significantly by the popularity of meme coins. This rise has positioned Solana as a major force in the industry, while Base has claimed the second spot, leaving Ethereum to fall to third place with just 10.8% of user activity. Analysts attribute Ethereum’s decline to fragmented interest across its Layer 2 solutions. But what does this mean for the blockchain ecosystem, and how has Solana leveraged meme tokens to reach this pinnacle?

Solana: The New Powerhouse

Solana’s ascension in the blockchain space is no accident. Known for its high-speed transactions and low fees, Solana has been a magnet for developers and users looking for a scalable blockchain solution. Its ability to process thousands of transactions per second has set it apart from competitors, making it a preferred choice for projects that demand efficiency.

What’s driving Solana’s dominance, however, is the rise of meme coins. These tokens, often created with lighthearted intentions or as internet jokes, have gained serious traction among crypto enthusiasts. Solana’s low transaction costs make it an ideal platform for trading meme coins, which often rely on high-frequency trading and large transaction volumes.

Tokens like Bonk, Cheems, and Samo have captured the imagination of the crypto community, leading to massive increases in transaction volume on Solana. Their popularity isn’t just a reflection of internet culture but also demonstrates the blockchain’s capability to handle viral trends without succumbing to network congestion.

Base: A Surprising Contender

Occupying the second spot in global blockchain traffic is Base, a Layer 2 blockchain built on Ethereum by Coinbase. Base has quickly risen in popularity due to its user-friendly ecosystem and strong backing from Coinbase, a major name in the crypto industry. While its infrastructure leverages Ethereum’s security, Base has successfully attracted users with faster transactions and lower fees.

Base’s ability to integrate seamlessly with Ethereum while offering improved scalability has made it a strong competitor. The blockchain has attracted both decentralized applications (dApps) and meme coin creators, who see it as a middle ground between Ethereum’s security and Solana’s speed.

Despite its achievements, Base still lags behind Solana, which enjoys a larger ecosystem and higher user engagement, thanks to its early adoption of meme tokens. However, Base’s rise is a clear indicator of growing competition in the Layer 2 space.

Ethereum: The Fragmented Giant

Ethereum, once the undisputed leader in blockchain traffic, has seen its dominance wane. Currently, it accounts for only 10.8% of global user activity, a stark contrast to its earlier days as the go-to blockchain for developers and users alike.

Analysts point to fragmentation as a key factor in Ethereum’s decline. The proliferation of Layer 2 solutions like Arbitrum, Optimism, and zkSync has divided Ethereum’s user base, spreading activity across multiple platforms. While these Layer 2 solutions improve scalability and reduce fees, they inadvertently dilute Ethereum’s overall traffic.

Moreover, Ethereum’s high transaction costs and slower processing speeds compared to newer blockchains have made it less appealing for certain use cases, particularly meme coins. Many users prefer platforms like Solana and Base for trading meme tokens, leaving Ethereum with less traffic in this rapidly growing sector.

The Role of Meme Coins in Blockchain Popularity

Meme coins have proven to be more than just a passing trend in the crypto space. These tokens, which often start as humorous or satirical projects, have developed dedicated communities and significant market caps. Their success is driven by several factors:

- Community Engagement: Meme coins thrive on strong, active communities that drive adoption and trading volume. Platforms like Solana and Base have capitalized on this by providing the infrastructure needed to support these communities.

- Low Entry Barriers: The affordable transaction costs on Solana and Base make them attractive for meme coin creators and traders. In contrast, Ethereum’s high fees can be prohibitive for smaller projects and individual traders.

- Virality: Meme coins often go viral on social media platforms, attracting a wide audience of users who might not typically engage with crypto. This influx of new users benefits blockchains that can handle the increased traffic without compromising performance.

- Speculation: The volatile nature of meme coins attracts traders looking for high-risk, high-reward opportunities. This speculative activity contributes to increased transaction volumes on the blockchains that host these tokens.

Challenges and Opportunities Ahead

While Solana’s dominance is noteworthy, it also highlights broader trends and challenges within the blockchain space. The rise of meme coins, while beneficial in terms of traffic, raises questions about the sustainability of such growth. Critics argue that relying on meme tokens could make blockchains vulnerable to market volatility and trends that may not last long.

For Ethereum, the challenge lies in unifying its ecosystem and addressing the inefficiencies that have driven users to other platforms. With the Ethereum 2.0 upgrade and continued development of Layer 2 solutions, there is potential for the blockchain to regain its footing. However, this will require a strategic focus on reducing fees and improving user experience.

Base, on the other hand, must work to solidify its position as a Layer 2 solution while competing with Solana’s superior scalability and Ethereum’s established reputation. Its success will depend on how well it can attract developers and users from its larger competitors.

Conclusion

The current state of blockchain traffic underscores the dynamic nature of the crypto industry. Solana’s rise, powered by meme coins, reflects the importance of adaptability and innovation in capturing user interest. Base’s emergence as a strong contender shows that newer platforms can quickly carve out a space in the market, while Ethereum’s decline serves as a cautionary tale about the risks of fragmentation and high costs.

As meme coins continue to shape the blockchain landscape, it will be interesting to see how these trends evolve and whether Solana can maintain its dominance. The competition among blockchains is fierce, and the winners will be those that can balance scalability, affordability, and user engagement in a rapidly changing environment.

In the end, the blockchain ecosystem is far from static, and the race for dominance is an ongoing battle. Solana, Base, and Ethereum each have unique strengths and challenges, ensuring that the next phase of blockchain development will be as unpredictable as it is exciting.