Bitcoin Surges to $92,700, Becoming the World’s 7th Largest Asset by Market Capitalization

In a historic turn of events, Bitcoin (BTC), the world’s leading cryptocurrency, has surged to an astounding price of $92,700, catapulting it into the ranks of the top-7 global assets by market capitalization. This remarkable milestone underscores the growing importance of cryptocurrencies in the broader financial ecosystem and marks another chapter in Bitcoin’s ongoing journey to challenge traditional asset classes like gold, stocks, and bonds.

Bitcoin’s Market Performance: A New Era

Bitcoin’s meteoric rise to $92,700 is not just a fleeting moment but a sign of the increasing institutional and retail investor interest in digital assets. As of today, Bitcoin’s market capitalization has surpassed $1.8 trillion, positioning it among the giants of global assets, including companies like Tesla, Meta (formerly Facebook), and even government debt in some nations. This surge comes amid a backdrop of global economic uncertainty, inflation concerns, and a growing shift towards alternative assets.

The last few years have seen a significant transformation in Bitcoin’s image, transitioning from a volatile, speculative asset to a more widely accepted store of value. Many investors now see Bitcoin as “digital gold,” a hedge against inflation, and a way to diversify portfolios. Its rise has not only been fueled by retail traders but has also been supported by large institutional players like MicroStrategy, Tesla, and Square, who have added Bitcoin to their balance sheets.

Factors Driving Bitcoin’s Rise

Several factors have contributed to Bitcoin’s ascent to new all-time highs. These include:

1. Institutional Adoption

One of the biggest catalysts for Bitcoin’s recent surge has been the growing institutional adoption. High-profile investors and corporations have shown increasing interest in holding Bitcoin as a hedge against inflation and as a non-correlated asset in an increasingly uncertain global economy. The entry of firms like BlackRock, Fidelity, and Goldman Sachs into the Bitcoin market has provided a strong vote of confidence, signaling that the cryptocurrency has evolved from a niche asset to a mainstream financial instrument.

2. Regulatory Clarity

Although cryptocurrencies have long faced regulatory scrutiny, recent movements toward clearer regulations have provided greater confidence in the market. Countries such as the United States, European Union members, and even certain regions in Asia have introduced or are considering cryptocurrency regulations that are more supportive of innovation while ensuring consumer protection. The passage of Bitcoin-related ETFs (exchange-traded funds) in several countries has also made it easier for traditional investors to gain exposure to Bitcoin without directly owning it.

3. Economic Uncertainty

As global economies grapple with inflationary pressures, supply chain issues, and geopolitical instability, Bitcoin has gained traction as an alternative store of value. While Bitcoin remains volatile, its scarcity—capped at 21 million coins—provides it with an inherent value proposition similar to that of gold. In times of currency devaluation or uncertain economic conditions, many see Bitcoin as a digital safeguard against the erosion of purchasing power.

4. Increased Demand from Retail Investors

Retail interest in Bitcoin has been steadily growing, spurred on by a greater understanding of the technology and its potential for financial freedom. Platforms like Coinbase, Binance, and Kraken have made it easier for individual investors to access Bitcoin, while financial apps like PayPal, Square, and Robinhood have integrated cryptocurrency trading into their platforms. This has democratized access to Bitcoin, bringing it to a larger audience.

Bitcoin and the Global Asset Rankings

As Bitcoin now ranks among the top-7 assets in the world by market capitalization, it is an important moment for the entire cryptocurrency space. Bitcoin’s rise has brought attention to the broader digital asset class, which includes Ethereum, Binance Coin, Cardano, and other altcoins. But Bitcoin remains the dominant force in the sector, accounting for roughly 40% of the total cryptocurrency market capitalization.

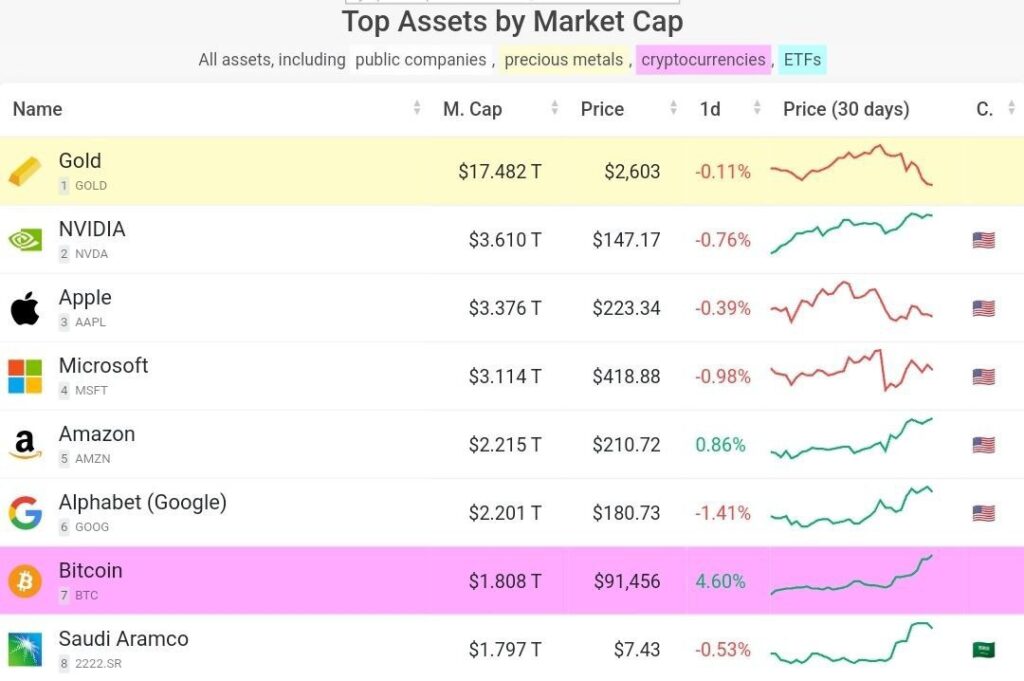

To put Bitcoin’s new position in perspective, here’s a look at how Bitcoin compares with other top global assets by market cap:

- Gold: Gold remains the largest asset by market cap, with an estimated $12 trillion market cap.

- U.S. Stock Market: The U.S. stock market, as represented by the S&P 500 index, has a market cap of over $40 trillion.

- Bitcoin: At $92,700 per coin, Bitcoin now holds a market cap of approximately $1.8 trillion, making it larger than many major tech companies and even entire countries’ economies.

- Apple: With a market cap of $2.7 trillion, Apple is still the world’s largest company by market value but is closely followed by Bitcoin.

- Amazon: Amazon’s market capitalization is approximately $1.3 trillion, putting Bitcoin ahead of this e-commerce giant as well.

- Microsoft: Microsoft is another tech leader with a market cap around $2.5 trillion.

- Tesla: With a market cap of around $950 billion, Tesla has also seen its market value surge over the years, but it remains smaller than Bitcoin at this stage.

Bitcoin’s ability to outpace these tech titans and other global assets signals its increasing mainstream acceptance and validates the belief that digital currencies can play a central role in the global financial system.

What’s Next for Bitcoin?

While Bitcoin’s rise has been impressive, many are asking what the future holds for the cryptocurrency. A variety of scenarios could unfold:

1. Continued Institutional Adoption

Bitcoin’s future seems increasingly tied to its growing institutional adoption. As more hedge funds, private equity firms, and large corporations embrace Bitcoin, the digital asset could continue to see upward momentum. The increasing development of infrastructure around Bitcoin and other cryptocurrencies will make it easier for institutions to gain exposure without taking on the same level of risk associated with earlier forms of investment in digital assets.

2. Regulation and Policy Development

How governments choose to regulate Bitcoin will also play a critical role in its future growth. While some countries are still skeptical, others like El Salvador have embraced Bitcoin as legal tender. If major economies like the United States, Europe, or China introduce favorable policies, Bitcoin could continue to cement its position as a mainstream asset.

3. Technological Advancements

The ongoing development of Bitcoin’s underlying technology could also have a major impact on its future. Innovations such as the Lightning Network, which allows for faster and cheaper transactions, could help Bitcoin become more practical for everyday use. Additionally, improvements in scalability and privacy could enhance its appeal among a broader audience.

Conclusion

Bitcoin’s rise to $92,700 and its position as one of the top-7 global assets by market capitalization is a landmark event in the history of finance. It signifies a broader shift in the way we think about money, value, and financial systems. As more people and institutions embrace Bitcoin, its role in the global economy will continue to evolve, presenting both challenges and opportunities for investors and regulators alike.

For now, Bitcoin’s surge is a testament to its growing legitimacy as a store of value and an asset class in its own right. Whether it will continue to climb the ranks or face hurdles remains to be seen, but one thing is certain: Bitcoin has firmly secured its place in the financial landscape of the 21st century.