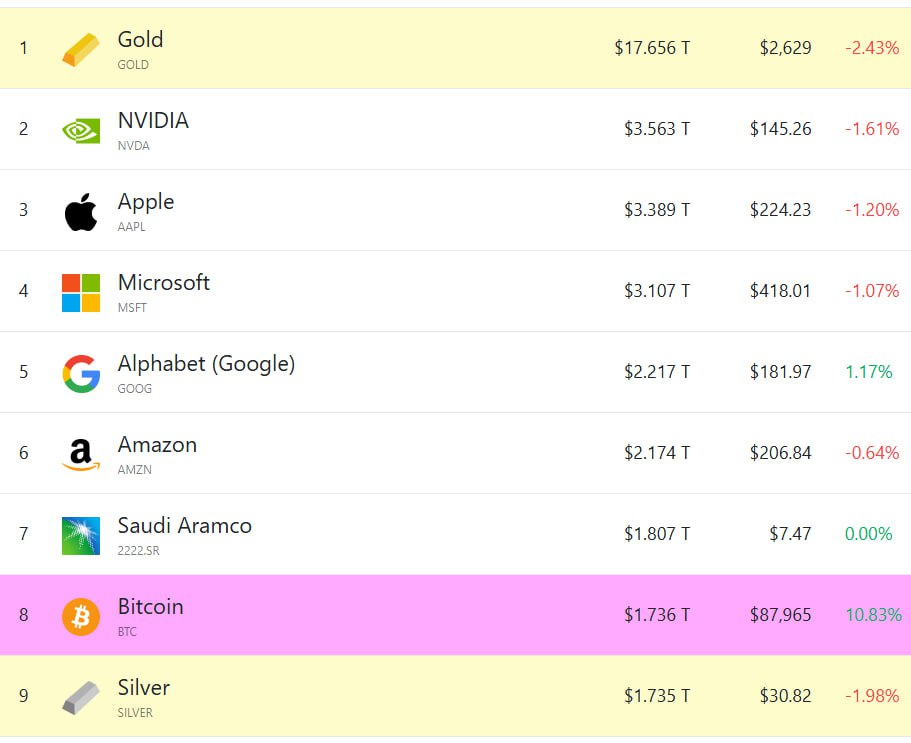

Just imagine—within 24 hours, the market cap of the leading cryptocurrency increased by $157 billion. As money continues to pour into the crypto world following Donald Trump’s reelection last week, bitcoin has climbed to yet another record high. The world’s largest cryptocurrency topped $89,000 for the first time, briefly peaking at $89,995 early Tuesday, according to CoinDesk.

Bitcoin’s Surge and Its Connection to Donald Trump’s 2024 Election Victory: An In-Depth Analysis

Bitcoin’s trajectory has been nothing short of remarkable. From its early days as a niche digital asset, it has evolved into a global financial powerhouse, routinely challenging traditional investment paradigms. Over the last decade, Bitcoin has seen exponential growth, driven by a combination of technological advancements, increasing mainstream adoption, and shifting political dynamics. Among the most striking political events that have coincided with Bitcoin’s meteoric rise is the victory of Donald Trump in the 2016 U.S. presidential election, as well as his successful re-election bid in 2024. Bitcoin’s price, which has surged past $89,000 in 2024, has captured the attention of both investors and analysts alike. Many have begun to question whether Trump’s two terms in office have had a lasting influence on Bitcoin’s price, or if this surge is the result of broader economic and technological trends. This article explores the intersection of Bitcoin’s explosive growth and Donald Trump’s political tenure, seeking to understand how his policies and the climate during his administrations may have influenced the cryptocurrency’s ascendance.

The Rise of Bitcoin: From Innovation to Mainstream Investment

Bitcoin, created in 2009 by the pseudonymous Satoshi Nakamoto, was born out of the desire to create a decentralized currency that could function outside the reach of traditional financial institutions and governments. Initially, Bitcoin was little more than a curiosity, largely dismissed by the mainstream financial world. But over the years, Bitcoin’s appeal grew, particularly in the wake of the 2008 financial crisis. Its promise as a store of value and hedge against inflation resonated with many, especially as central banks around the world printed money in unprecedented quantities.

Despite its volatile nature and early skepticism from financial experts, Bitcoin slowly began to garner the attention of institutional investors, large corporations, and governments. By 2016, the cryptocurrency had begun to gain real traction, particularly as a speculative asset, as interest in blockchain technology and cryptocurrencies at large started to rise. However, it wasn’t until the unexpected political events of 2016—when Donald Trump triumphed in a divisive U.S. presidential election—that Bitcoin’s potential as a hedge against political and economic uncertainty truly began to be realized by a broader audience.

Donald Trump’s First Term: A Catalyst for Bitcoin’s Early Growth

Trump’s unexpected victory in 2016 was a shock to many, both domestically and internationally. His policies, particularly in areas such as trade, regulation, and monetary policy, introduced a level of unpredictability that sparked concern among investors. The rise of populism, protectionism, and a general distrust of the establishment created a fertile ground for Bitcoin to flourish as a viable alternative to traditional financial systems.

As Trump’s policies began to take shape, particularly his aggressive stance on trade and criticism of the Federal Reserve, many investors sought to protect their wealth from potential market disruptions. Bitcoin, with its decentralized nature and limited supply, became an increasingly attractive option for those looking for a hedge against inflation, currency devaluation, or political instability. Trump’s policies, including his tax cuts, trade wars, and regulatory challenges, further increased the appeal of decentralized digital assets, as they were seen as immune to the traditional financial system’s vulnerabilities.

By the end of 2017, Bitcoin had experienced an explosive rise, peaking at nearly $20,000. Though the price would eventually see a correction, the fundamental interest in Bitcoin as a store of value remained intact. Investors, many of whom were initially drawn in by the promise of quick profits, began to recognize Bitcoin’s potential as a long-term asset that could stand independent of government policy, central banks, and geopolitical crises.

The 2024 Re-Election of Donald Trump: Fueling Bitcoin’s Latest Surge

Fast forward to 2024, and Donald Trump’s re-election bid has reshaped the political landscape once again. While the specifics of Trump’s second term policies remain to be fully seen, his victory has sent ripples through the global financial system, further elevating Bitcoin’s position as a dominant asset. In fact, Bitcoin’s price has surged past $89,000—its highest value ever—around the time of Trump’s re-election, prompting analysts to ask: Is there a direct connection between Trump’s political fortunes and Bitcoin’s meteoric rise?

There are several factors that may explain the latest surge in Bitcoin’s price in connection with Trump’s re-election. As in 2016, there is a renewed sense of economic uncertainty surrounding Trump’s policies. With a global economy still reeling from the effects of the COVID-19 pandemic, inflationary pressures, and geopolitical tensions (such as ongoing conflicts and trade disputes), many investors are looking for safe havens to protect their wealth. Central banks, particularly the U.S. Federal Reserve, have continued their expansionary policies, including low interest rates and massive monetary stimulus measures. These policies have contributed to a decline in the purchasing power of fiat currencies, making Bitcoin’s limited supply and store-of-value proposition more appealing.

Trump’s victory in 2024 also further solidified the distrust in centralized systems of control. His administration has shown a continued preference for deregulation, a stance that resonates with Bitcoin advocates who see decentralized currencies as a way to sidestep government interference. At the same time, Trump’s vocal criticisms of the Federal Reserve and his efforts to reshape international trade dynamics add fuel to the fire for those seeking alternative financial systems. As Bitcoin’s decentralized nature shields it from government influence, it has come to be seen not only as an investment but as a form of resistance to the very economic and financial systems that Trump’s administration seeks to influence.

Institutional Adoption and Mainstream Recognition: Key Drivers of Bitcoin’s Price Surge

While political factors undoubtedly play a role in Bitcoin’s price movements, there are other structural factors driving its growth. The increasing institutional adoption of Bitcoin is perhaps one of the most important catalysts. In 2024, Bitcoin is no longer just a speculative asset or a fringe investment for tech enthusiasts—it has become a legitimate asset class, with major institutional players like BlackRock, Fidelity, and MicroStrategy embracing Bitcoin as part of their portfolios.

The launch of Bitcoin exchange-traded funds (ETFs), the growing presence of Bitcoin futures and options markets, and the increasing number of corporations accepting Bitcoin for transactions have all contributed to its rise in value. These developments have made Bitcoin more accessible to retail investors and have significantly boosted its credibility in the eyes of mainstream finance.

Furthermore, the rise of Bitcoin as a financial asset has coincided with increasing regulatory clarity in many regions, including the U.S. and Europe. While there remains some uncertainty surrounding cryptocurrency regulation, the growing recognition of Bitcoin as a store of value has helped boost its institutional acceptance. In this climate, Bitcoin has become part of the broader conversation on digital finance and is often viewed as a legitimate alternative to gold and other traditional hedges.

Bitcoin as a Symbol of Decentralized Resistance

The political backdrop of the Trump presidency has created an environment in which Bitcoin’s appeal as a symbol of decentralized resistance against government overreach and inflationary monetary policies has only grown stronger. Trump’s combative rhetoric towards the Federal Reserve, his trade wars, and his populist stance on global economic affairs have all driven more people toward the idea of self-sovereignty, which Bitcoin represents. Whether or not one agrees with Trump’s policies, it is clear that his leadership has spurred an appetite for alternative systems that are insulated from the political forces driving traditional economies.

Bitcoin’s decentralized nature stands in stark contrast to Trump’s frequent interventions in economic policy. While traditional markets are subject to central control and regulation, Bitcoin’s open-source, peer-to-peer network is governed by code, not politicians. As governments continue to print money and centralize control, Bitcoin represents a vision of financial autonomy that appeals to many investors and libertarians alike.

Conclusion: The Future of Bitcoin in a Trumpian World

Bitcoin’s rise to over $89,000 in 2024 is not simply a product of speculative mania or short-term market movements. It is the result of a complex interplay between technological innovation, changing global financial dynamics, and political uncertainty. Donald Trump’s first term set the stage for Bitcoin’s rise, but his re-election in 2024 has added fuel to the fire, as investors increasingly view Bitcoin as a hedge against political instability, inflation, and government intervention.

While Bitcoin’s price movements can never be fully predicted, it is clear that its role as a decentralized, global asset is only growing stronger. Whether under Trump’s leadership or in a future shaped by other political forces, Bitcoin’s ability to remain insulated from centralized control positions it as a cornerstone of the future financial ecosystem.

Bitcoin’s path forward will undoubtedly be influenced by both political events and market forces, but its ascent to over $89,000 in 2024 is a clear sign that it has earned its place as a legitimate financial asset and an enduring symbol of the potential for a new, decentralized financial system. As the political landscape continues to evolve, Bitcoin will remain a powerful force for change in the world of finance.