In the cryptocurrency world, the term “bull run” refers to periods of rapid price increases, marked by a surge in buying activity and investor enthusiasm. These phases, which occur in distinct stages, reflect a unique psychology and market pattern in the crypto ecosystem. The ability to recognize these stages and navigate them effectively is vital for both seasoned investors and newcomers alike.

This article dives into the phases of a crypto bull run, explores the dynamics behind each stage, and provides insight into how traders can make the most out of these exciting yet challenging market conditions.

Stage 1: Accumulation Phase

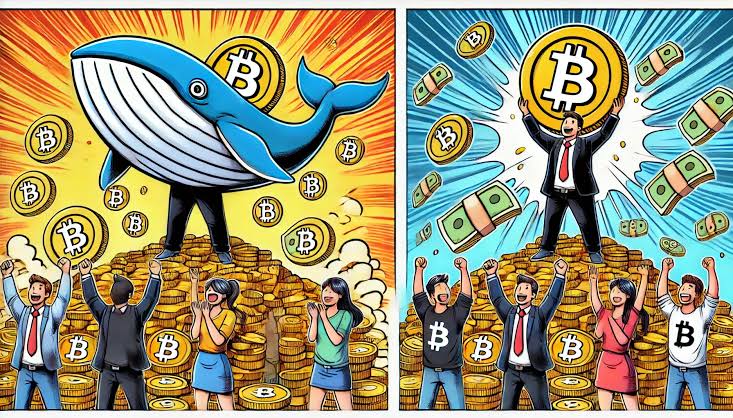

The first stage of a crypto bull run is the Accumulation Phase. Typically, this stage occurs after a bear market or a prolonged period of price stability. During the accumulation phase, big players, often called “whales,” begin to buy cryptocurrencies at relatively low prices. These whales—large investors with significant holdings—play a major role in accumulating assets without drawing much attention.

The accumulation phase is generally characterized by low trading volumes and minimal price movement. Most casual investors are not actively participating in the market during this time, as it often appears stagnant or “boring” to those seeking quick gains. In contrast, strategic investors see this as a prime opportunity to build their portfolios quietly.

For investors, the key to success in this phase is patience. Those who recognize the potential for a future bull run can use this stage to accumulate assets at favorable prices. They are willing to wait, knowing that the broader public has yet to catch on.

Stage 2: Early Rally Phase

Following the accumulation phase is the Early Rally Phase. This stage marks the beginning of a slow, steady rise in cryptocurrency prices. During this phase, buying pressure gradually increases, and subtle signs of upward momentum become visible. In the early rally phase, astute traders and analysts may start noticing breakouts or significant increases in trading volumes, both of which signal the start of a potential bullish trend.

Unlike the quiet accumulation phase, the early rally phase garners the attention of experienced investors who are keen on identifying trends before the masses. At this point, prices are still relatively low, and the general public remains unaware of the market’s shift. However, experienced traders start accumulating more aggressively, preparing for what they believe is the beginning of a bull market.

The early rally phase is a golden opportunity for those who recognize it. Since the market has not yet fully taken off, prices remain attractive, offering a chance to accumulate more assets before the public enters the fray.

Stage 3: Public Participation Phase

The Public Participation Phase is the most noticeable phase of a bull run. As prices continue to rise, the media, influencers, and everyday investors begin to take note of the market’s upward trajectory. This phase is often fueled by news stories, social media posts, and online forums discussing the rapid increase in cryptocurrency values.

During the public participation phase, retail investors—those who have limited market knowledge—begin to buy in, fearing they might miss out on potential gains. The surge in buying activity causes prices to rise even faster, as the combined demand from both experienced and inexperienced investors leads to upward momentum.

This phase is often accompanied by heightened media coverage, creating a “hype cycle” that encourages even more people to invest. As prices rise rapidly, trading volumes surge, and the market becomes increasingly active. Investors experience a mix of FOMO (fear of missing out) and excitement, fueling the rally even further.

While this phase can be profitable, it also brings with it a level of risk. As prices skyrocket, the risk of buying overvalued assets increases. Investors should exercise caution, particularly those new to the market who may not fully understand the risks of investing at these elevated prices.

Stage 4: Euphoria Phase

The Euphoria Phase represents the peak of the bull run, where optimism reaches its highest point, and prices reach new all-time highs. During this phase, nearly everyone in the market is bullish, and the sentiment is overwhelmingly positive. This “irrational exuberance,” as some might call it, is fueled by the belief that prices will continue to climb indefinitely.

In the euphoria phase, inexperienced investors may feel confident that prices will only go up, leading them to buy assets at record highs. This phase often leads to inflated valuations, as speculation drives prices far beyond the assets’ intrinsic value. For many, this phase represents the most exciting part of the bull run, with media coverage reaching a fever pitch and prices hitting extreme levels.

While it may seem tempting to invest during this time, it is also the riskiest phase of the bull run. Prices can be highly volatile, and a sudden downturn can lead to significant losses. Savvy investors might choose to take profits during this phase, selling part or all of their holdings to lock in gains before a potential correction occurs.

Stage 5: Distribution Phase

Following the euphoria phase is the Distribution Phase. In this stage, experienced investors and whales start selling their holdings, recognizing that prices have reached unsustainable levels. As they begin to take profits, the increased selling pressure slows down the rapid price rise, and growth may start to level off or even decline slightly.

The distribution phase can be difficult for inexperienced investors to recognize, as they may not see the signs of a market top. However, a shift in sentiment often becomes evident, with prices struggling to break higher and trading volumes beginning to decrease. This phase is a telltale sign that the bull run is coming to an end, as whales gradually “distribute” their assets to new buyers who are unaware of the impending correction.

For investors, this phase represents a critical time to reevaluate their positions. Those who entered during the early phases of the bull run may consider taking profits, while others may choose to exit the market entirely to avoid the risk of a downturn.

Stage 6: Downtrend and Correction Phase

The final stage of a bull run is the Downtrend and Correction Phase. As the name implies, this phase is marked by a sharp decline in prices, often due to a combination of selling pressure and reduced demand. Fear begins to replace excitement, and investors who bought near the top may start to panic-sell as prices drop.

During this phase, the market experiences a substantial correction, and prices fall back to more sustainable levels. In some cases, this phase can lead to a new bear market, where prices remain low for an extended period.

While this phase can be discouraging for investors, it also presents new opportunities. Those who exited during the euphoria or distribution phases may now have the chance to buy back assets at lower prices. Additionally, investors who maintain a long-term perspective can see this correction as a healthy part of the market cycle, offering a fresh opportunity to accumulate assets in anticipation of the next bull run.

Conclusion

Understanding the stages of a cryptocurrency bull run can help investors navigate the market’s ups and downs more effectively. By recognizing these stages—Accumulation, Early Rally, Public Participation, Euphoria, Distribution, and Downtrend/Correction—investors can make more informed decisions about when to buy, hold, or sell assets.

Each phase comes with its own unique risks and opportunities, and those who can accurately identify them are better positioned to maximize profits and minimize losses. Whether you’re a beginner or an experienced trader, understanding the psychology and behavior driving these stages is essential to navigating the crypto market successfully.

As with any investment, it’s crucial to manage risks, remain patient, and avoid getting caught up in the hype. By following these principles, investors can navigate the crypto bull run cycle and make the most of the opportunities it presents.