Russia-U.S. tensions hit global markets as Putin lowers the threshold for a nuclear strike

Published Tue, Nov 19 20247:29 AM EST

Updated 17 Min Ago

- Kremlin leader Vladimir Putin has amended Russia’s nuclear doctrine that outlines the conditions that would prompt Moscow to deploy its nuclear arsenal, Russian state news agency Tass reported Tuesday.

- Investors took cover in safe-haven assets amid declines in global stocks.

- “The conflict is escalating … I clearly expect to see some kind of immediate reaction, knee-jerk reaction,” Tiffany McGhee, CEO and CIO of Pivotal Advisors, told CNBC’s “Worldwide Exchange.”

Russian President Vladimir Putin speaks during a plenary session of the Valdai Club on Nov. 7, 2024 in Moscow, Russia.

Contributor | Getty Images News | Getty Images

Global stocks fell and investors fled to safe-haven assets on Tuesday, as global markets reacted to escalating tensions between the world’s two largest nuclear powers: Russia and the U.S.

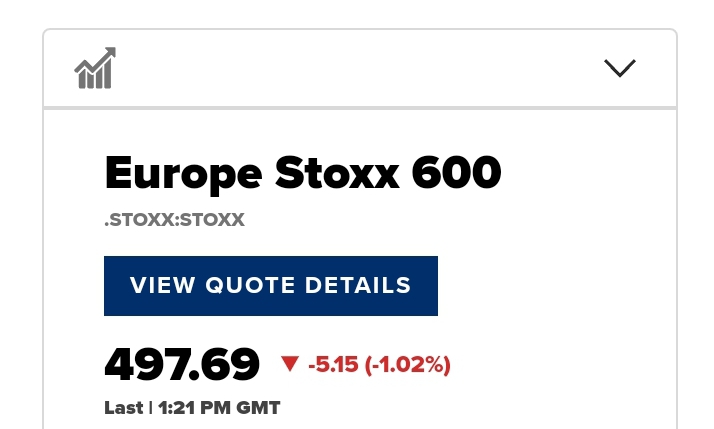

The pan-European Stoxx 600 stock index was down almost 1% at 12:23 p.m. London time, hitting 498.56 points — its lowest level since August. In the U.S., stock futures tied to the Dow Jones Industrial Average fell 0.5%, S&P futures slid around 0.2%, while Nasdaq 100 futures lost 0.1%.

The declines come after Russian President Vladimir Putin amended Russia’s nuclear doctrine that outlines the conditions that would prompt Moscow to deploy its nuclear arsenal, Russian state news agency Tass reported Tuesday.

Critically, Russia has now widely expanded the circumstances under which it will consider nuclear retaliation, with Kremlin Spokesperson Dmitry Peskov saying the updated code now “states that the Russian Federation reserves the right to use nuclear weapons in the event of aggression with the use of conventional weapons against it or the Republic of Belarus, which creates a critical threat to sovereignty or territorial integrity. Aggression against the Russian Federation by any non-nuclear state with the participation or support of a nuclear state is considered a joint attack,” according to NBC News reporting

Stoxx 600

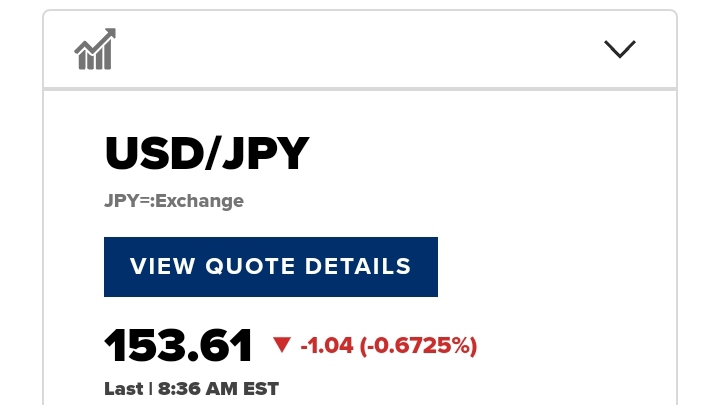

The prospect of a potential nuclear escalation propeled investors into safe-haven markets, with gold prices up 0.8% at 11:52 a.m. London time. In currency markets, the Japanese yen rose 0.7% and 0.36% against the euro and U.S. dollar respectively at 12:26 a.m. London time. The Swiss franc, meanwhile, added 0.3% against the euro.

“The sharp drop in bond yields and USDJPY was of course notable, but I think even more telling is how quickly it … faded,” Wells Fargo Macro Strategist Erik Nelson told CNBC over email, in reference to the U.S. dollar and Japanese yen exchange.

“There is clearly still a bias to position for higher inflation and sturdy growth as we get into the final weeks of the year. Market participants likely recall the headline risk from the earlier stages of the Russian-Ukraine war and will likely be inclined to fade any dips in yields and USDJPY so long as any indications of escalation remain more verbal in nature.”

Yen/dollar

While Moscow had signaled an interest in updating its nuclear doctrine months prior, the amendments are nevertheless being implemented within days of a U.S. decision to allow Kyiv to use American-made long-rage missiles in Russian territory — a key reversal of Washington’s policy regarding the war in Ukraine. It remains to be seen whether other allies of the NATO coalition, which supply crucial military and humanitarian aid to Ukraine, will fall in line with the White House on authorizing Kyiv to use their locally-made weapons during offensives targeting Russian soil.

NATO allies have so far largely steered clear of this step, fearing retaliatory measures from Moscow. Putin has previously alluded to the risk of nuclear provocation if the coalition formally intercedes in the war, stating in June that Russia was ramping up its nuclear arsenal — already the largest worldwide, after the Kremlin inherited the vast majority of the collapsed Soviet Union’s weapons of mass destruction.

As the Ukraine conflict on Tuesday commemorated its 1,000th day, the Russian Defense Ministry said that Kyiv has already deployed six U.S.-made long-range ballistic missiles in an overnight strike in the Bryansk region in the west of the country, according to NBC reporting. In a Google-translated Facebook update, the Ukrainian General Staff of the Armed Forces said it had “inflicted a fire” in Bryansk without specifying whether Kyiv had utilized America-made arsenal to that end.

Markets will rally into year-end and potentially be strong next year too: Defiance ETFs’ Jablonski

“The conflict is escalating … I clearly expect to see some kind of immediate reaction, knee-jerk reaction,” Tiffany McGhee, CEO and CIO of Pivotal Advisors, told CNBC’s “Worldwide Exchange.”

She stressed the need to review the market impact in the long term, however, noting similar short-lived reactions since Russia’s wholescale invasion of its neighbor in February 2022.

“But in terms of longer-term, this is year three of the conflict and while initially we saw spikes in prices … that’s kind of leveled off,” she said.

Oil markets, which have been most directly affected by the war following Western sanctions on Russian oil supplies, remained in negative territory on Tuesday despite the heightened possibility of a confrontation between two of the world’s largest crude producers.

The Ice Brent contract with January expiry was down 0.37% at 12:33 a.m. London time, with front-month December Nymex WTI futures lower by 0.74%, both compared with the Monday settlements.

Yenimahalle su kaçak tespiti Bakırköy’deki evimdeki su kaçağını çok hızlı bir şekilde buldular. Teşekkür ederim. https://travelwithme.social/ustaelektrikci

great articlemonperatoto Terpercaya

Cumhuriyet su kaçak tespiti Maltepe’deki ofisimdeki su kaçağını bulmak hiç kolay değildi ama bu ekip harika çalıştı. https://medlink.live/ustaelektrikci