published: November 14, 2024 at 12:49 AM GST

updated: November 14, 2024 at 12:50 AM

3 mins readNews

- Bitcoin paused at $86,340 as investors await US CPI data, impacting short-term price movements and market sentiment.

- Peter Brandt predicts Bitcoin could hit $134K or $327K, with optimism tied to future regulatory clarity and pro-crypto policies.

- Bitcoin’s Futures Open Interest dropped 3%, with long-term holders showing caution, signaling market stability amid economic uncertainty.

Bitcoin’s recent price surge experienced a halt as investors shifted their focus to critical US Consumer Price Index (CPI) inflation data. This data, set to be released soon, could shape market sentiment and determine short-term price movements. Despite the pause in momentum, Bitcoin remains a hot topic among analysts, with some projecting major future price shifts.

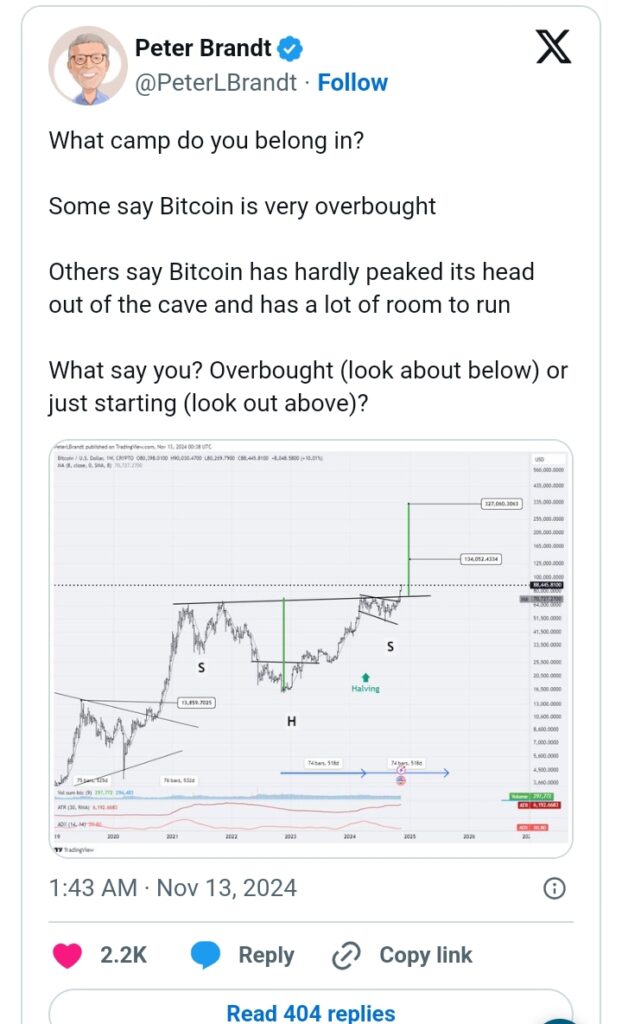

Notably, veteran trader Peter Brandt took to X, formerly Twitter, to share his bullish forecast on Bitcoin’s potential. Brandt suggested that Bitcoin could reach unprecedented highs, with two possible price paths outlined.

More so, one target is $134,000, while the higher scenario could propel Bitcoin to $327,000. He noted that although some investors believe Bitcoin is overbought, others argue the bull run is only beginning. Consequently, this wide range of opinions adds to the intrigue surrounding Bitcoin’s price trajectory.

https://x.com/PeterLBrandt/status/1856498170382926076?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1856498170382926076%7Ctwgr%5E8a07fa4ab120d5da16e3e99c6ed09f327489dbf8%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fcryptonewsland.com%2Fbitcoin-price-could-hit-327k-peter-brandt-predicts-if-this-happens%2F

Chart Analysis Shows Mixed Outlook

Additionally, Brandt’s chart, which highlighted both bullish and bearish scenarios, captured the market’s attention. The lower target of $134,000 appears more realistic in the near term. However, the higher range outlook, which hints at $327,000, reflects a significant level of optimism.

According to Brandt, regulatory clarity and potential pro-crypto policies in the United States could influence Bitcoin’s long-term rally. This is especially relevant as regulatory bodies continue to impact crypto market sentiment.

In addition, analysts at Bernstein have also echoed Brandt’s predictions, forecasting Bitcoin’s rise to $200,000. Their analysis aligns with the optimistic view of a sustained upward trend. However, caution remains as economic uncertainties could alter these expectations.

Particularly, the upcoming CPI data is crucial. It could prompt a temporary pullback in Bitcoin’s price as investors digest the economic impact and anticipate Federal Reserve decisions.

Investor Sentiment Remains Cautious

Meanwhile, prominent crypto analyst Ali Martinez offered a different perspective on the current market sentiment. Martinez pointed out that long-term Bitcoin holders are showing caution despite recent price gains. He noted that these holders are not displaying “extreme greed,” a factor that often signals the beginning of a market frenzy. Their restraint suggests a measured level of confidence and stability, which may influence Bitcoin’s gradual momentum.

https://x.com/ali_charts/status/1856561880774418674?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1856561880774418674%7Ctwgr%5E8a07fa4ab120d5da16e3e99c6ed09f327489dbf8%7Ctwcon%5Es1_c10&ref_url=https%3A%2F%2Fcryptonewsland.com%2Fbitcoin-price-could-hit-327k-peter-brandt-predicts-if-this-happens%2F

Martinez’s observations provide context for the broader market sentiment, indicating a cautious yet optimistic approach. This aligns with Brandt’s view of a potential rally, though Martinez suggests a slower buildup.

Additionally, the anticipation surrounding US CPI inflation data adds to the market’s cautious outlook. The data could have ripple effects on financial markets and possibly trigger adjustments in Bitcoin prices.

Bitcoin’s Short-Term Movements Under Watch

Bitcoin’s price today reflected investor hesitation, trading down by over 2%, around $86,340. It reached a 24-hour high of $89,015.57 but still fell short of surpassing its recent all-time high of $90,100. Futures Open Interest for Bitcoin also dropped nearly 3% in the past 24 hours.

This indicates that investors are waiting on the sidelines, anticipating the impact of forthcoming economic data. Additionally, trading volume saw a decline of 14%, reflecting the cautious market approach.

With the look of things it is possible for his prediction to come true

Wow

Really?🥺

due to the various analysis breakdown on Bitcoin

we can actually convince individuals to follow it up