The Price of 1 Bitcoin Surpasses the Price of 1 Kilogram of Gold: What This Means for the Future of Finance

In a historic milestone for both the cryptocurrency and precious metals markets, the price of one Bitcoin (BTC) has recently surpassed the price of one kilogram of gold. For the first time ever, the value of a single Bitcoin has exceeded the cost of owning a full kilogram of gold, a precious asset that has been used as a store of value and a hedge against inflation for centuries. This momentous occasion has raised eyebrows across the financial world, sparking debates about the future of money, digital assets, and the role of traditional commodities in the global economy.

In this article, we’ll break down what this price shift means, how we got here, and what implications it may have for the future of both Bitcoin and gold as financial assets.

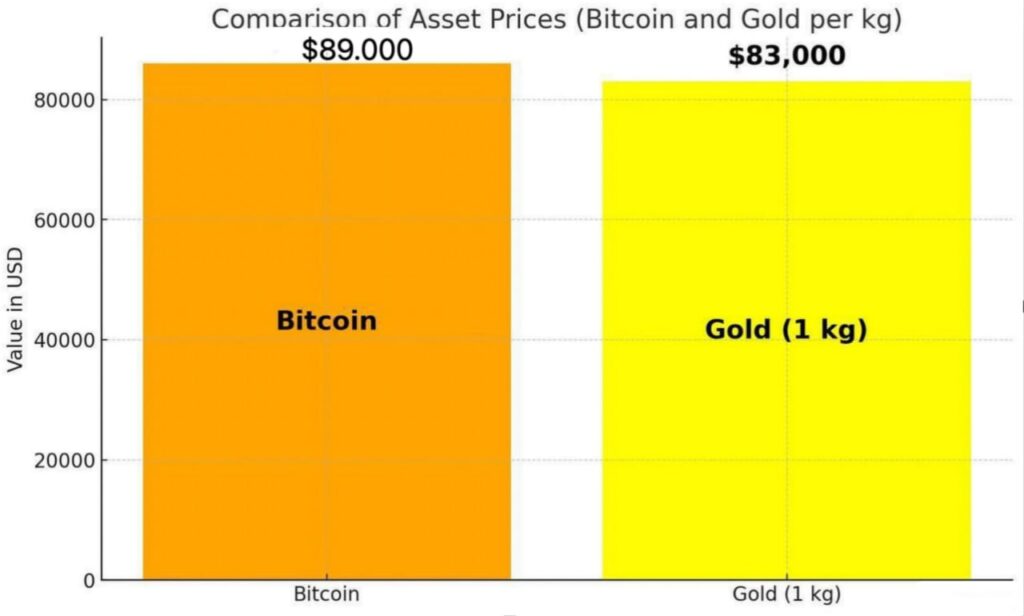

The Price of 1 Bitcoin vs. 1 Kilogram of Gold

As of mid-November 2024, the price of Bitcoin has surged past $65,000 per coin. Meanwhile, the price of one kilogram of gold, depending on market fluctuations, hovers around $60,000 to $65,000. The comparison between Bitcoin and gold has always been a topic of interest among investors, particularly as Bitcoin has increasingly been seen as “digital gold.” However, surpassing the price of a kilogram of gold adds a new layer of significance to this ongoing comparison.

To put things into perspective, a single kilogram of gold weighs 1,000 grams. The price of gold per gram is approximately $60, which means that one kilogram of gold is worth about $60,000 to $65,000, depending on market conditions. On the other hand, Bitcoin’s price has recently surged past the $65,000 threshold, making it more valuable than a full kilogram of gold.

This price crossover is symbolic, signaling the increasing legitimacy and acceptance of Bitcoin as a viable financial asset in the global economy. It also marks a significant shift in the narrative surrounding digital currencies and their potential to rival traditional assets like gold, which has long been considered a “safe haven” during times of economic uncertainty.

How Did We Get Here? Bitcoin’s Rise to Prominence

To understand how Bitcoin has reached this price point, it’s essential to look at its history. Bitcoin was created in 2008 by an anonymous figure or group known as Satoshi Nakamoto, with the vision of creating a decentralized, peer-to-peer digital currency that could bypass traditional financial institutions. The first Bitcoin transaction occurred in 2009 when Nakamoto mined the first block of Bitcoin, known as the “genesis block,” which contained a reward of 50 BTC.

In the early days, Bitcoin had little to no value, and its use was mostly limited to a niche group of tech enthusiasts and cryptographers. However, as Bitcoin’s blockchain technology gained recognition for its security, transparency, and decentralized nature, demand began to grow. Early adopters of Bitcoin saw its potential as a store of value, much like gold, but with the added benefit of being easily transferable across borders without the need for intermediaries like banks.

Fast forward to today, Bitcoin has seen exponential growth in its adoption. Institutional investors, including major financial firms and even publicly traded companies, have entered the Bitcoin market, pushing its price to new heights. Bitcoin is now widely regarded as both a speculative investment and a potential hedge against inflation, particularly in an era of unprecedented monetary policy stimulus and rising national debts.

The increased institutional interest, along with growing retail adoption and the introduction of Bitcoin exchange-traded funds (ETFs), has driven Bitcoin’s price to new record highs. Its limited supply—only 21 million Bitcoin will ever be mined—has also helped to create a sense of scarcity, driving demand and increasing its value. The price of Bitcoin is influenced by a range of factors, including market sentiment, regulatory developments, and technological advancements within the broader cryptocurrency ecosystem.

Why Is Bitcoin Surpassing Gold Significant?

Bitcoin surpassing the price of one kilogram of gold holds significant implications for both investors and the broader financial system. Here are a few key reasons why this moment is noteworthy:

1. Digital Gold: A New Asset Class?

Bitcoin is often referred to as “digital gold,” and this milestone underscores the growing belief that Bitcoin can serve as a store of value much like gold. While gold has been a store of value for millennia, Bitcoin’s decentralized nature, limited supply, and ease of transfer make it an attractive alternative for those looking for a more modern, digital form of wealth preservation. With Bitcoin now more expensive than a kilogram of gold, it sends a clear message to investors and analysts alike that Bitcoin is increasingly seen as a legitimate asset with long-term value.

2. Hedge Against Inflation

In times of economic uncertainty or rising inflation, many investors turn to gold as a safe haven. However, Bitcoin’s price surge has led many to view it as an alternative hedge against inflation. As central banks around the world continue to print money, Bitcoin’s fixed supply of 21 million coins makes it an appealing option for those looking to safeguard their wealth from currency devaluation. The fact that Bitcoin now holds a higher value than a kilogram of gold could signal a shift in investor preferences toward digital assets.

3. A Symbol of the Digital Economy

The rise of Bitcoin over gold represents a broader shift toward the digital economy. Traditional financial systems and assets like gold are deeply entrenched in physicality and centralized control. Bitcoin, on the other hand, operates on a decentralized, digital platform that transcends national borders and traditional financial institutions. Its success in surpassing gold’s price highlights the increasing dominance of digital currencies and blockchain technology, which are reshaping the global financial landscape.

4. Reimagining the Role of Central Banks and Monetary Policy

Bitcoin’s rise challenges the traditional role of central banks and fiat currencies. Unlike traditional money, which can be printed at will by governments, Bitcoin’s supply is strictly limited by code, making it immune to inflationary pressures from government policies. As Bitcoin becomes more widely adopted, it could challenge the authority of central banks, leading to a rethinking of monetary policy and potentially altering the dynamics of global financial systems.

The Road Ahead: Will Bitcoin Continue to Outpace Gold?

While Bitcoin’s price may have surpassed gold in terms of value per unit, it’s important to note that Bitcoin and gold serve different purposes in the global economy. Gold has long been a trusted store of value, a hedge against economic instability, and a foundation for global monetary systems. Bitcoin, on the other hand, is still a relatively young asset with a history of high volatility. It remains to be seen whether Bitcoin can maintain its current price trajectory, or if market forces will lead to corrections in the future.

That said, Bitcoin’s rise is a clear indication of the changing attitudes toward money, wealth, and investment in the 21st century. As adoption increases and the technology behind Bitcoin matures, it could continue to challenge traditional assets like gold, particularly as investors seek out assets that offer not only store of value but also the potential for growth and innovation in the digital age.

Conclusion

The fact that Bitcoin’s price has surpassed the price of a kilogram of gold is a momentous occasion that signals the growing acceptance of cryptocurrencies as legitimate financial assets. While this development may cause some to reconsider their traditional views on money and wealth preservation, it also highlights the increasingly important role that digital assets will play in the future of finance. Whether or not Bitcoin continues to outpace gold in terms of value, it is clear that the cryptocurrency has emerged as a major player in the global financial ecosystem, and its influence is only set to grow in the years ahead.

The Future of Bitcoin vs. Gold: Can the Trend Continue?

As we look to the future, the key question is whether Bitcoin will continue to outperform gold in terms of value. While Bitcoin’s recent surge has been impressive, its price volatility remains a concern for some investors. Gold, with its centuries-long track record as a store of value, remains a much more stable and predictable asset. However, Bitcoin’s appeal lies in its potential for growth, its decentralization, and its ability to operate in a global, digital economy. As more institutional investors adopt Bitcoin and as its use case continues to expand, the cryptocurrency may continue to outpace traditional assets in terms of returns, albeit with higher risk.

Moreover, Bitcoin’s technological advancements and the broader blockchain ecosystem will likely play a role in its future value proposition. Innovations such as the introduction of Bitcoin Layer 2 solutions (e.g., the Lightning Network) could improve scalability, transaction speed, and cost, making Bitcoin more accessible and usable for everyday transactions. This would further strengthen Bitcoin’s position as a digital alternative to traditional financial systems.

Final Thoughts

In conclusion, the fact that Bitcoin now commands a higher price than a kilogram of gold is a significant milestone that marks the growing acceptance of digital currencies. As we enter an increasingly digital world, Bitcoin’s rise challenges traditional notions of wealth and monetary policy, offering a glimpse into the future of finance. While it remains to be seen whether Bitcoin can maintain this trajectory, one thing is clear: the digital revolution in finance is well underway, and Bitcoin is leading the charge.