Robert Kiyosaki Doubles Down on Bitcoin, Vows to Keep Buying Until It Surpasses $100,000

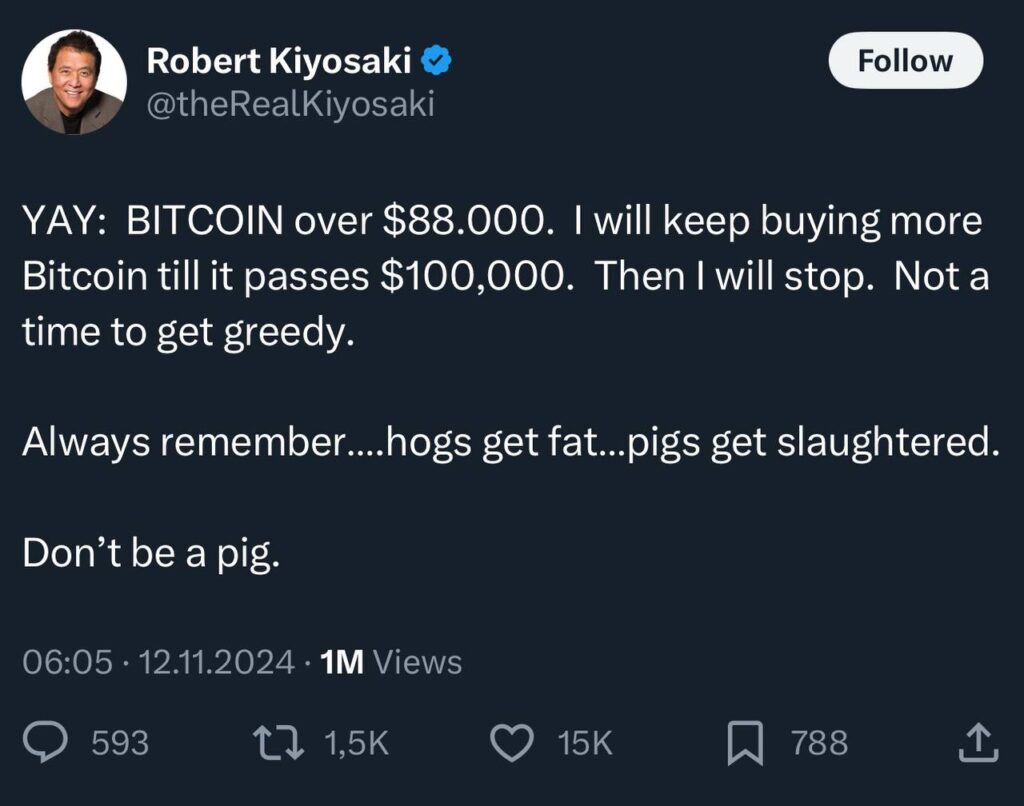

In a recent tweet that sparked both enthusiasm and debate among financial circles, Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, once again emphasized his belief in the long-term potential of Bitcoin as a wealth-building asset. Kiyosaki, known for his contrarian views and unique take on personal finance, shared his intention to continue purchasing Bitcoin until its value surpasses the $100,000 mark. His statement resonated with followers who admire his financial acumen, as well as with critics who question the speculative nature of cryptocurrencies.

Kiyosaki’s Bitcoin Strategy: A Focus on the Long-Term

Robert Kiyosaki’s comments highlight his long-term investment strategy, which aligns with his overarching financial philosophy of focusing on assets rather than short-term price movements. While many investors often get caught up in the volatility of the markets, Kiyosaki urges his followers to think beyond daily fluctuations and instead concentrate on acquiring assets that have the potential to grow in value over time. This approach, according to Kiyosaki, is key to building sustainable wealth.

Kiyosaki has been an outspoken advocate of Bitcoin for several years, often positioning it as a hedge against inflation and a safer bet compared to traditional fiat currencies. In his tweet, he made it clear that he sees Bitcoin not just as a speculative investment, but as a means of safeguarding wealth in a world of rising inflation and economic uncertainty.

Bitcoin’s role as an inflation hedge is particularly relevant today, as central banks around the world continue to print vast amounts of money in response to economic challenges. Many people have started to view Bitcoin and other cryptocurrencies as a store of value, much like gold, but with the added advantages of being decentralized and easily transferable.

The Importance of Asset Accumulation

The concept of asset accumulation is central to Kiyosaki’s philosophy. He has often emphasized the difference between liabilities and assets, urging people to focus on acquiring income-generating assets rather than liabilities that drain wealth. For Kiyosaki, Bitcoin represents a modern form of digital gold—an asset that has the potential to appreciate significantly in the coming years, especially as governments and institutions continue to expand their monetary policies.

By continuing to buy Bitcoin, Kiyosaki is not just advocating for a single asset but is promoting a broader mindset that prioritizes wealth-building through smart asset acquisition. Unlike conventional savings accounts or traditional investments that often offer minimal returns, Bitcoin has proven itself to be a high-risk, high-reward investment, with the potential for massive upside in the future.

Kiyosaki’s latest tweet also serves as a reminder to his followers that focusing on the long-term value of assets is more important than obsessing over day-to-day market fluctuations. In a world where short-term thinking often dominates, especially among retail investors chasing quick profits, Kiyosaki’s emphasis on patience and strategic accumulation stands in stark contrast. His belief in Bitcoin’s future value underscores his commitment to a philosophy of wealth-building that relies on discipline, foresight, and a clear understanding of market dynamics.

Bitcoin’s Current Value and the Road to $100,000

As of now, Bitcoin is far from the $100,000 milestone that Kiyosaki envisions. The cryptocurrency has experienced significant volatility over the years, with dramatic price swings that have caused many to doubt its long-term viability. However, Kiyosaki’s tweet is indicative of his belief that Bitcoin’s price is still in the early stages of its growth cycle.

At the time of writing, Bitcoin has seen a series of peaks and valleys, but its overall trend has been upwards, with a general increase in adoption and recognition from both retail and institutional investors. Factors such as increased interest from financial institutions, advancements in blockchain technology, and the growing recognition of Bitcoin as a store of value could drive its price higher in the coming years.

Kiyosaki’s target of $100,000 may seem ambitious to some, but it is not entirely out of reach. In fact, many analysts and cryptocurrency enthusiasts believe that Bitcoin could surpass this level in the near future, particularly if global economic conditions continue to push individuals and institutions toward alternative forms of value storage.

Kiyosaki’s Broader Views on Cryptocurrency and the Financial System

While Kiyosaki is an avid supporter of Bitcoin, he is also vocal about his skepticism toward traditional financial systems, including fiat currencies, stocks, and bonds. He has repeatedly warned against the dangers of relying too heavily on conventional assets that are influenced by government policies and central banks. In his books and speeches, Kiyosaki has often pointed to the U.S. dollar’s decline in purchasing power over time, as well as the erosion of wealth caused by inflation.

In contrast, Kiyosaki views Bitcoin as a safeguard against the erosion of wealth due to inflation and central bank policies. He has been particularly outspoken about the risks of holding fiat currencies, calling them “fake” money and urging people to diversify into real assets like gold, silver, and Bitcoin. According to Kiyosaki, the future of money will not be tied to traditional currencies, but rather to decentralized digital assets that offer transparency, security, and the potential for significant growth.

For Kiyosaki, Bitcoin represents a new paradigm in personal finance, one that gives individuals more control over their wealth and provides a hedge against the fail

In his latest tweet, Robert Kiyosaki, the renowned author of Rich Dad Poor Dad and a prominent advocate for financial education, shared his intention to keep purchasing Bitcoin until its price surpasses the $100,000 mark. His statement has sparked considerable attention among his followers and the broader financial community, especially given his long-standing advocacy for gold, silver, and Bitcoin as key pillars in building wealth.

Kiyosaki’s tweet wasn’t just about his personal investment strategy; it was a reminder to his followers about the importance of focusing on assets that have long-term value, rather than getting distracted by the short-term price fluctuations that are common in markets like cryptocurrency. Kiyosaki’s perspective on wealth creation is rooted in the idea that true wealth is built over time by acquiring assets that are not only likely to appreciate but also provide protection against inflation and economic uncertainty.

The Philosophy Behind Kiyosaki’s Investment Strategy

One of the central tenets of Kiyosaki’s financial philosophy is the concept of “cash flow.” In his book Rich Dad Poor Dad, he contrasts the financial habits of his two fathers—his biological father (whom he calls his “Poor Dad”) and the father of his best friend (whom he calls his “Rich Dad”). His “Rich Dad” teaches him that building wealth is about acquiring assets that generate cash flow—things like real estate, stocks, and, in recent years, cryptocurrencies like Bitcoin.

Kiyosaki’s support for Bitcoin is based on the asset’s potential to hedge against inflation, which has become increasingly important given the current economic landscape. With central banks around the world printing vast amounts of money in response to economic downturns, many investors view Bitcoin as a store of value, similar to gold. This is one of the reasons Kiyosaki has consistently urged his followers to invest in Bitcoin, despite the asset’s volatility. He believes that while Bitcoin’s price can be unpredictable in the short term, its long-term trajectory is upward, especially as more people and institutions begin to see it as a viable alternative to traditional currencies and gold.

In his tweet, Kiyosaki also emphasized that the obsession with short-term price movements can be detrimental to long-term wealth creation. For many investors, it’s easy to get caught up in the day-to-day fluctuations of the market. The volatility of assets like Bitcoin can trigger panic selling during downturns or cause people to miss out on future gains because they are too focused on immediate results. Kiyosaki warns against this mindset, advocating instead for a long-term approach to investing that involves buying quality assets and holding onto them through periods of volatility.

Bitcoin: A Hedge Against Inflation and Economic Uncertainty

Kiyosaki’s tweet is also a reflection of the growing belief among some financial experts that Bitcoin can act as a hedge against inflation. As traditional currencies lose value due to inflation, Bitcoin’s limited supply (capped at 21 million coins) makes it a deflationary asset, unlike fiat currencies that can be printed in unlimited amounts. This scarcity aspect of Bitcoin is a key part of its appeal. Kiyosaki’s focus on this idea suggests he sees Bitcoin as a potential “safe haven” asset, similar to gold.

For Kiyosaki, Bitcoin isn’t just a speculative investment; it’s a way to protect wealth from the dangers of inflation and currency devaluation. In the wake of the 2008 financial crisis and the ongoing economic challenges, many investors are looking for ways to diversify their portfolios and secure their financial futures. Bitcoin’s rise in popularity over the past decade has positioned it as an increasingly important asset for those looking to hedge against traditional financial risks.

Additionally, Bitcoin’s decentralized nature is another reason Kiyosaki champions the digital currency. Unlike traditional currencies, which are controlled by governments and central banks, Bitcoin operates on a decentralized blockchain, making it resistant to manipulation by any one entity. This feature aligns with Kiyosaki’s broader philosophy of financial independence, where individuals take control of their own wealth rather than relying on traditional financial institutions.

The Importance of Focusing on Assets, Not Price Fluctuations

Another key element of Kiyosaki’s message in the tweet is the importance of focusing on acquiring assets rather than getting caught up in short-term price fluctuations. The financial markets are inherently volatile, and prices can swing dramatically from day to day. For those who are new to investing, this volatility can be unnerving, leading to hasty decisions, such as selling off investments at a loss during a market downturn.

Kiyosaki’s approach, however, is to view price fluctuations as part of the natural market cycle. Instead of letting market swings dictate his investment decisions, Kiyosaki emphasizes the importance of buying assets that have intrinsic value and will continue to appreciate over time. In his case, this includes Bitcoin, which he views as a long-term investment that, despite its volatility, will ultimately see its value rise as more people recognize its potential as a store of value.

The key, according to Kiyosaki, is to think long term. Wealth is not built by reacting to every market movement or chasing the latest trend. True wealth is built by acquiring assets that will stand the test of time. Bitcoin, with its decentralized structure, fixed supply, and growing adoption, is a prime example of an asset that Kiyosaki believes will increase in value over the years.

The Future of Bitcoin and Kiyosaki’s Continued Investment

As Bitcoin continues to gain traction and institutional interest, Kiyosaki’s prediction of a $100,000 price tag doesn’t seem entirely out of reach. The cryptocurrency market is still relatively young, and Bitcoin’s adoption

W88 là nhà cái cá cược trực tuyến uy tín hàng đầu Châu Á, được đông đảo người chơi Việt Nam tin tưởng lựa chọn. Nổi tiếng với kho tàng trò chơi đa dạng, tỷ lệ cược hấp dẫn và dịch vụ khách hàng chuyên nghiệp, W88 mang đến trải nghiệm cá cược đẳng cấp cho mọi người chơi https://w88go.vip