A wild Journey

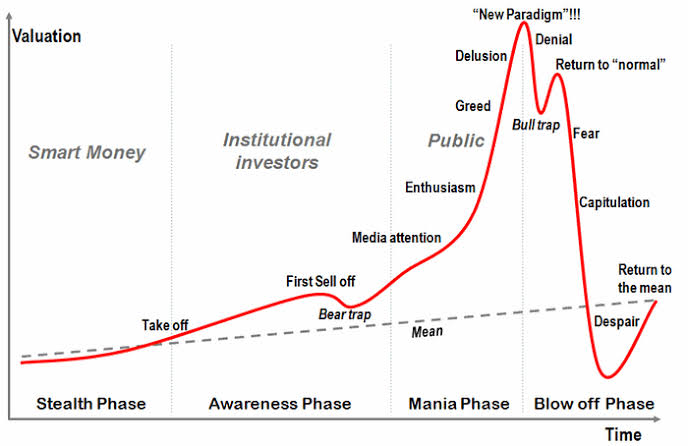

The crypto market cycle is a wild and unpredictable journey, filled with twists and turns that can leave even the most seasoned investors breathless.

It’s a cycle of highs and lows, of hope and despair, of greed and fear. In this article, we’ll explore the different stages of the crypto market cycle and the emotions that come with them.

To have a complete information about the cycle, you must be aware of the Bitcoin halving event. This is highly important.

The Bitcoin Halving

This is what the previous Bitcoin market cycles have ALL been based around.

This is an event that happens roughly every 4 years and essentially halves the rewards given to miners causing an inherent increase in demand as the cost of mining a bitcoin doubles.

The reason crypto doesn’t just go up forever is because markets are cyclical, everyone who was going to buy has…….And then the most money to be made is to the downside.

No matter how many times you hear Blackrock Vanguard, Microsoft, Google, PayPal, Visa, Elon Musk, China, El Salvador, John McAfee bulls it, Crypto and every other market…has always followed a pattern which anyone interested in it should learn.

The events and Disguise

The way they do this is by doing exactly what we’re seeing now

“Btc has never gone under previous cycles ATH, 200 weekly MA etc. So buyers rush in at these levels just to get crushed again

This is to disenchant retail buyers, kill sentiments and elude to the fact that once again “crypto is dead”

After the market has been driven down so hard that the majority of investors lose interest (and money) then the big boys will start accumulating at the lowest prices possible

This will only happen once the majority of retail has stopped providing liquidity on the other side of the trade for the big boys to sell into.

In other words, we need to get SO low that no one wants to touch BTC anymore

THEN, we get close to the halving and enter a Mark up phase.

After the halving, BTC will then cost more to mine and so it provides the perfect catalyst to start pushing up the market

The markup phase is when the market starts to run up hard, regaining retail traders attention, positive news, articles etc

Anyway, there’s a little bit more to understanding liquidity and institutional positioning but this is a hint.

The Calm Before the Storm

The market is quiet, with prices stable and no clear direction. Investors are cautious, waiting for a sign to buy or sell. It’s a time of uncertainty, but also a time of opportunity, emotion and anticipation.

Let’s look at few things in this phase;

Accumulation phase

Characterized by Slow sideways, low volatility market for about 3-6 months at the lows. This always starts about 12 months before the bull run

Mark up phase

This usually starts about 6 months before the halving

Distribution phase

Here, sellers start re entering the market, you can always spot this through.

Mark down phase

This is when retail traders keep anticipating the bottom and getting dumped on over and over again until we get closer to the halving

Then back to accumulation

After a huge sentiment killing bear market, BTC will sit in a low volatility sideways accumulation zone at the lows as the big boys scoop as much BTC as they can for as little as possible.

This gives you PLENTY of time to position

It doesn’t make sense for them to just run the market straight up because then the big boys need to pay more for their BTC.

In order for them to keep BTC at the lows, they need to kill retail sentiment beforehand so that retail doesn’t rush into the market and drive prices up before they’re ready to run things up.

The Bull Run

Prices start to rise, and the market is filled with excitement and optimism. Investors are eager to buy, and the fear of missing out (FOMO) sets in.

It’s a time of growth and profit. Euphoria is the emotion of the season

Prices surge upward, reaching new heights. Trading volume increases significantly and Media coverage intensifies, drawing in new investors.

Optimism and FOMO (Fear of Missing Out) fuel the rally, we also experience new investors entering the market, eager to profit.

Blockchain projects and innovations receive increased funding, Market capitalization expands, reaching new records.

Institutional investors and whales join the fray, Price predictions and hype reach a fever pitch

This period of rapid growth is a thrilling time for investors, but it’s essential to remain cautious and not get caught up in the excitement.

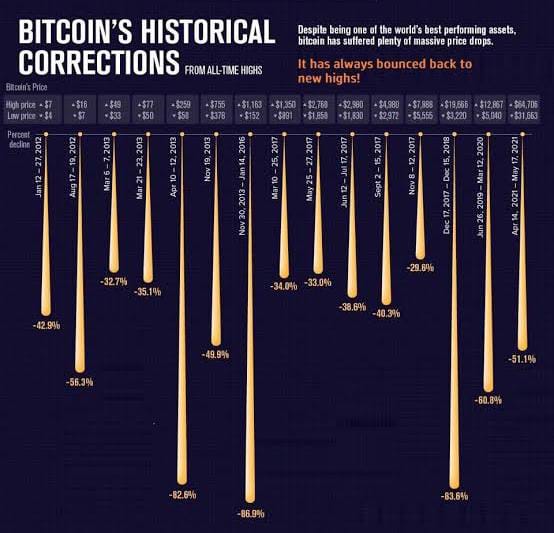

The Correction

The market reaches a peak and begins to correct, with prices falling and investors selling. It’s a time of panic and fear, as investors worry about losing their gains.

A correction is a natural market phenomenon allowing price move downward after a significant upswing.

It’s a period of consolidation, where the market absorbs the gains and prepares for the next move.

Market sentiment shifts from optimism to caution or fear, Investors take profits or sell to limit losses

Media coverage focuses on the decline, sparking fear and uncertainty, now Projects and innovations continue to develop, but at a slower pace.

A correction is not a crash, but rather a healthy adjustment that can help stabilize the market and prepare it for future growth.

It’s a time for investors to reassess their portfolios, take profits, and potentially rebalance their investments.

Remember, corrections are a normal part of the market cycle, and they can provide opportunities for savvy investors to buy the dip and prepare for the next run!

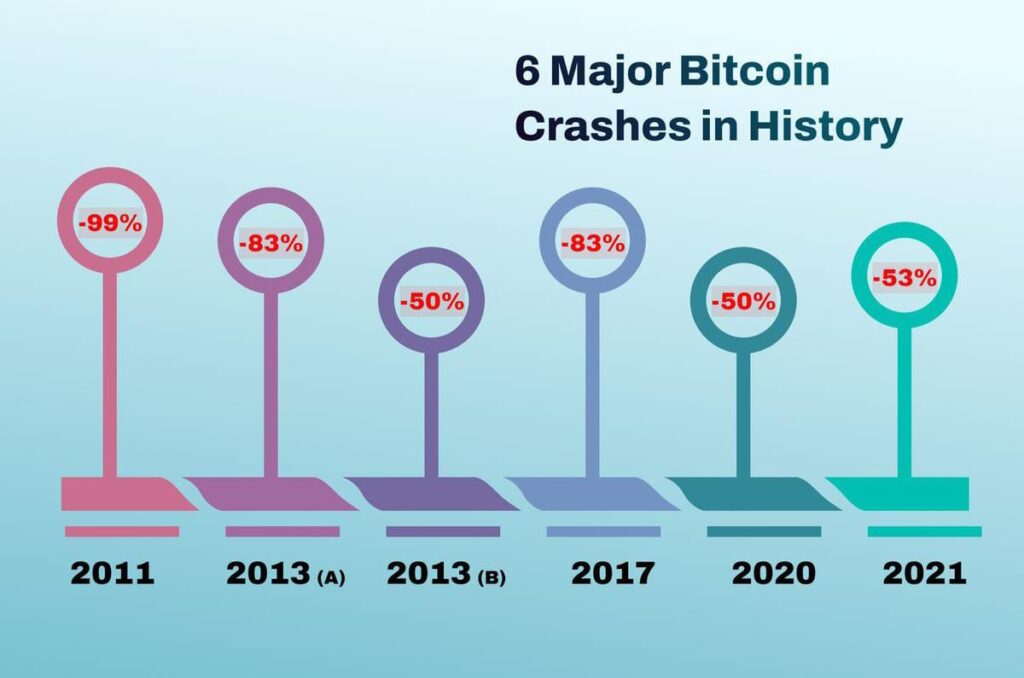

The Crash

The correction turns into a full-blown crash, with prices plummeting and investors scrambling to sell. It’s a time of despair and desperation.

There’s a sudden and drastic decline in the cryptocurrency market, sending prices into dips. A crash is a severe correction, often triggered by a combination of factors, including:

- Overvaluation: Prices become detached from fundamentals

- Market manipulation: Large-scale selling or dumping

- Global events: Economic or political shocks

- Regulatory changes: Stricter regulations or bans

- Investor panic: Fear and uncertainty fuel rapid selling

The crash is a harsh reminder of the crypto market’s volatility and the importance of risk management, diversification, and disciplined investing.

While devastating, a crash can also present opportunities for buying a good dip.

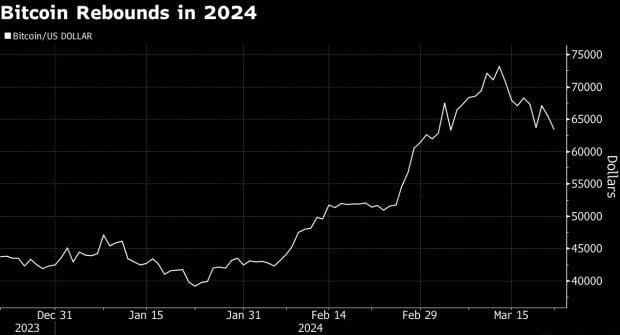

The Recovery

The market hits rock bottom and begins to recover, with prices rising and investors regaining confidence. It’s a time of hope and renewal, relief is around.

A period of healing and rejuvenation in the market, where prices gradually rise, and investor confidence is restored. A recovery is a natural phase of the market cycle, following a correction or crash, and is characterized by:

- Prices slowly and steadily increasing

- Trading volume gradually improving

- Market sentiment shifting from fear to optimism

- Projects and innovations regaining traction and funding

- Market capitalization expanding, signaling growth

- Investors regaining confidence and re-entering the market

- New investors entering the market, attracted by the growth potential

- The recovery can lead to a new bull market or a sustained period of stability

There are market dynamics that characterizes this event.

The recovery is a crucial phase, as it sets the stage for the next growth cycle. Investors can make informed decisions and thrive in the cryptocurrency market!

The crypto market cycle is a rollercoaster ride of emotions, with investors experiencing a range of feelings as the market fluctuates.

By understanding these stages and emotions, investors can better navigate the cycle and make informed decisions. So buckle up and enjoy the ride!

Moreover, we are at the beginning of something good

HOW DOES THIS MAKE YOU MONEY?

Be real, you didn’t buy or want to buy any coin because you’re “in it for the tech”…

The way you make money out of this is very simple

Markets work in phases and these are actually very easily identifiable… You leverage on them to position well.

There’s a lot money on crypto so as risks

Volatile instrument are not for the weak

Fix your psychology then Risk management

Money must be made

Lets make more money on this

Be wise

I’m really loving the theme/design of your site. Do you ever run into any web browser compatibility problems? A few of my blog readers have complained about my blog not operating correctly in Explorer but looks great in Chrome. Do you have any advice to help fix this problem?

Do you have a spam issue on this blog; I also am a blogger, and I was wondering your situation; we have created some nice methods and we are looking to exchange strategies with other folks, why not shoot me an email if interested.