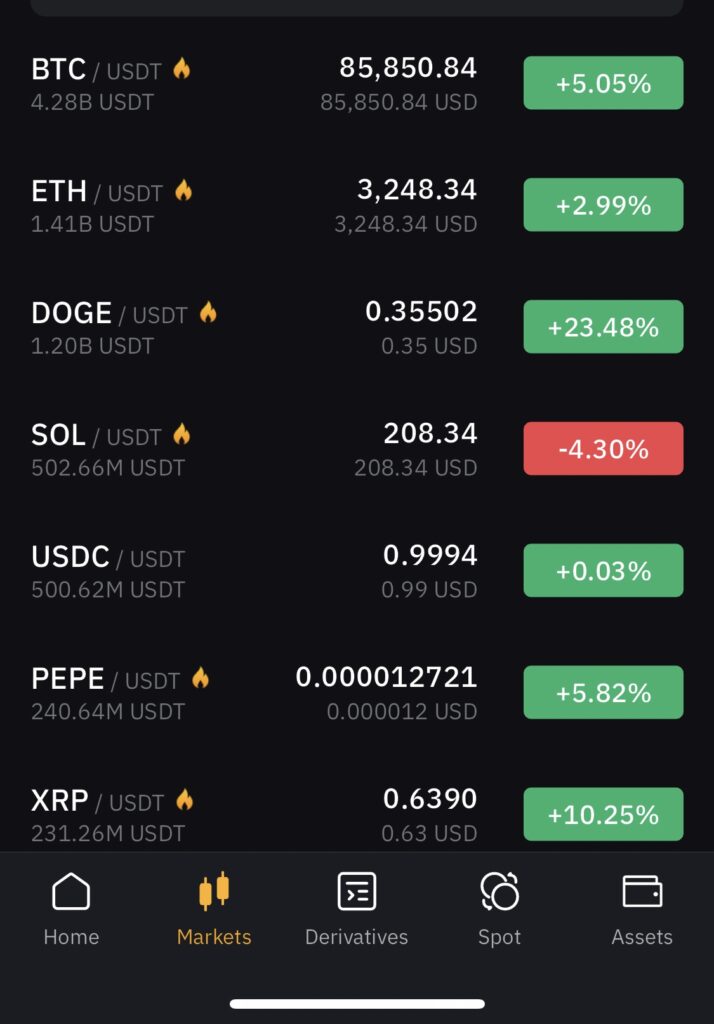

The U.S. presidential election results triggered a surge in crypto markets. Bitcoin hit a new high above $80,000, surpassing Meta in market cap, while Solana advanced to the fourth position among cryptos, valued at $100 billion.

Market liquidations exceeded $499 million, indicating the ongoing volatility. Investors are watching closely for further developments.

Crypto Prices Soar After U.S. Election: Market Surge Amid Political Uncertainty

The U.S. presidential election results, which were expected to have widespread implications across various sectors of the economy, have sent shockwaves through the cryptocurrency markets. In a surprising twist, the election outcome triggered an unprecedented surge in crypto prices, with Bitcoin reaching new all-time highs and other leading altcoins following suit. The events highlight the growing impact of political events on digital assets and underscore the increasingly significant role that cryptocurrency plays in the global financial ecosystem.

Bitcoin Breaks New Records

The biggest story from the crypto market post-election is undoubtedly Bitcoin’s explosive rally. Within hours of the election results, Bitcoin’s price shot past $80,000, setting a new all-time high. This surge saw Bitcoin surpassing the market capitalization of major tech giants like Meta (formerly Facebook), underscoring the rapidly growing prominence of digital currencies in the global financial landscape.

Bitcoin’s surge comes amid heightened institutional interest, increased adoption, and a growing consensus that digital assets offer a hedge against traditional financial market volatility. Historically, Bitcoin has been viewed as a store of value akin to gold, and many investors see it as a safer bet in uncertain economic times. With inflation fears and ongoing political instability, cryptocurrencies, and Bitcoin in particular, have become increasingly attractive to both retail and institutional investors alike.

Bitcoin’s new peak above $80,000 further cements its status as the leading cryptocurrency, a position it has held with relative consistency since its inception in 2009. The psychological milestone of crossing $80,000 has ignited renewed optimism in the crypto community, with many speculating that Bitcoin could reach even higher levels in the near future. Investors are also hoping that the rally signals the beginning of a new bull market, especially after a period of market correction earlier in the year.

Solana’s Stellar Performance

While Bitcoin’s surge dominated the headlines, another major player has made headlines with a remarkable rise. Solana (SOL), a blockchain platform known for its high throughput and low transaction costs, saw its market cap surpass $100 billion, propelling it into the fourth position among cryptocurrencies by market value.

Solana’s rapid rise has been fueled by growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs), areas where the platform has gained significant traction due to its scalability. In the wake of the election results, Solana’s price surged as investors began to realize its potential to compete with Ethereum in the smart contract space. As Ethereum continues to grapple with scalability issues and high gas fees, Solana’s faster, cheaper, and more efficient transactions have made it a popular alternative for developers and users in the DeFi ecosystem.

The election-induced rally provided a much-needed boost to Solana’s market cap, which had been fluctuating for much of the year amid broader market downturns. With the addition of high-profile projects and increased developer activity, Solana is now positioned to become one of the leading platforms in the blockchain space. As cryptocurrencies continue to gain mainstream attention, Solana’s ability to process transactions quickly and cost-effectively makes it a strong contender in the race for the top blockchain platform.

Market Liquidity and Volatility

While the surge in crypto prices is a positive sign for many investors, it has also sparked concerns about the increasing volatility in the market. According to data from various exchanges, market liquidations on both short and long positions have exceeded $499 million, signaling the level of risk involved for traders who are caught on the wrong side of the market.

The liquidation of leveraged positions is a common occurrence during periods of high volatility. When prices surge or drop unexpectedly, traders who have used borrowed funds to increase their position size can be forced to liquidate their holdings to cover their margin calls. The near half-billion-dollar figure in liquidations underscores how quickly sentiment can shift in the crypto market, where price swings of 10% or more in a single day are not uncommon.

However, these liquidations also demonstrate the ongoing maturation of the crypto market. Increased institutional participation means that more sophisticated market participants are involved, and many are seeking to capitalize on price volatility. But for retail investors, the risks are greater. The rapid influx of capital into crypto markets post-election has only amplified this volatility, leaving some questioning the sustainability of the rally.

Broader Implications for the Global Economy

The impact of the U.S. election on the cryptocurrency markets also speaks to a larger trend: the increasing intertwining of politics and digital finance. As governments around the world grapple with how to regulate and integrate cryptocurrencies into their economies, political events such as elections are becoming key drivers of market movement.

For example, the U.S. presidential election has significant consequences for crypto regulation, which remains a gray area in many jurisdictions. Depending on the new administration’s stance on digital currencies, policy changes could either foster further growth in the crypto space or introduce more regulatory hurdles. With the election results pushing Bitcoin to new heights, it’s clear that many investors are betting on a favorable regulatory environment in the U.S. and abroad.

The surge in crypto prices also comes amid growing concerns over the stability of traditional financial systems. Inflationary pressures, the potential for rising interest rates, and geopolitical instability have led many to seek alternative assets outside of the traditional banking system. Cryptocurrencies, with their decentralized nature and deflationary features (in the case of Bitcoin), have become increasingly attractive as a hedge against traditional economic risks.

Looking Ahead: What’s Next for Crypto?

As crypto prices soar in the wake of the election, investors are eagerly watching for any signs that the rally will continue or if a market correction is imminent. While some analysts are optimistic that Bitcoin could surpass $100,000 in the coming months, others caution that the current volatility is unsustainable in the long term.

In the short term, many are closely monitoring the regulatory landscape. How different governments choose to approach cryptocurrency regulation in the coming years will likely have a significant impact on market sentiment. Additionally, macroeconomic factors like inflation, interest rates, and geopolitical tensions will also play a key role in shaping the future of digital assets.

For now, though, the U.S. election results have sparked a renewed sense of optimism in the crypto markets, and investors are watching closely for any further developments. Whether this marks the beginning of a new bull market or another period of volatility remains to be seen, but one thing is certain: cryptocurrencies have firmly established themselves as a major player in the global financial system.

As the market continues to evolve, the crypto community will likely face both opportunities and challenges, but the election-induced surge signals that digital assets are here to stay as a force to be reckoned with.