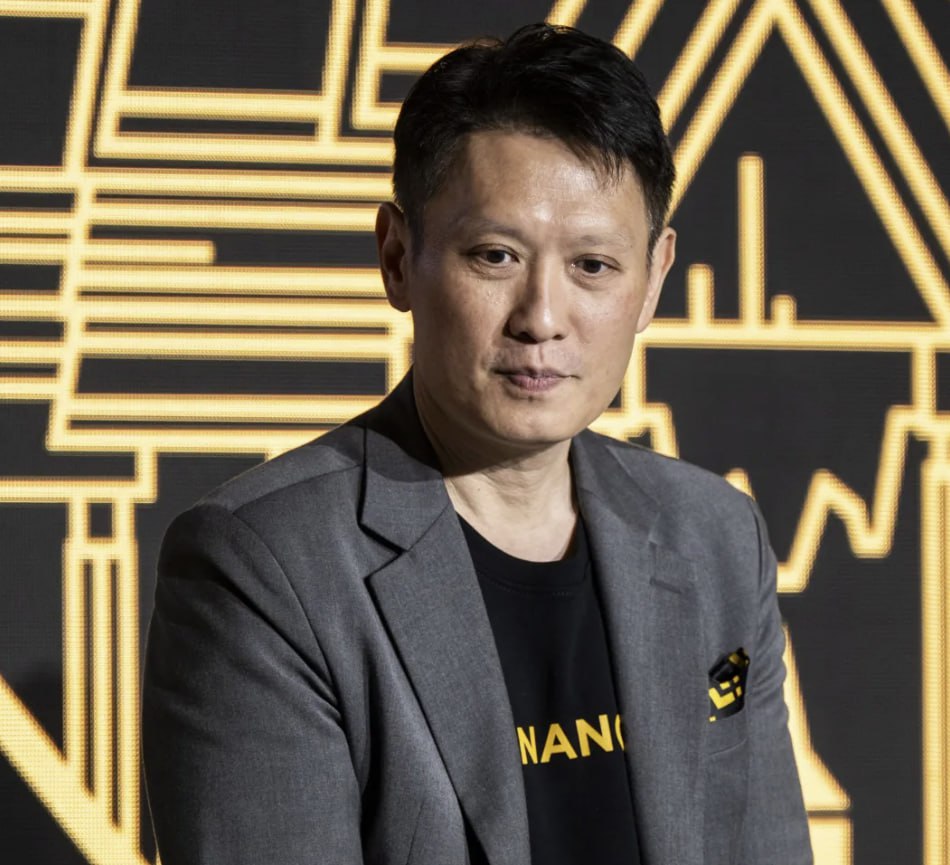

Binance CEO Richard Teng believes that with Donald Trump’s victory in the U.S. presidential election, a “golden age” for the cryptocurrency market could begin.

According to him, new regulators that are open to cryptocurrencies will soon emerge in the U.S.

Binance CEO Richard Teng: Cryptocurrencies Are Entering a “Golden Age” After Trump’s Victory

In the ever-evolving world of cryptocurrency, optimism often runs high, but sometimes it is a figure with considerable influence and foresight who provides a statement that crystallizes the industry’s trajectory. Richard Teng, the CEO of Binance, one of the largest and most prominent cryptocurrency exchanges in the world, recently shared his bullish views on the future of digital assets, particularly in light of Donald Trump’s victory in the U.S. presidential election. According to Teng, the cryptocurrency market is entering what he describes as a “golden age,” and much of this optimism stems from anticipated shifts in U.S. regulatory policy and the potential for broader mainstream adoption.

A New Era for Cryptocurrency Regulation

The cryptocurrency market has long faced a volatile relationship with regulatory bodies across the globe. In many countries, including the United States, digital assets have existed in a regulatory gray zone, with regulators oscillating between cautious scrutiny and embracing innovation. However, Teng believes that Trump’s victory in the 2024 presidential election could be a turning point, ushering in an era of clearer and more favorable regulations for cryptocurrencies.

“Under the previous administration, we saw significant progress, but I believe with Trump back in office, we’ll witness the rise of regulators who are not only familiar with cryptocurrencies but are open to their potential,” Teng remarked during a recent interview. He emphasized that Trump’s political platform, which has included support for pro-business policies and deregulation, could benefit the crypto industry by fostering an environment conducive to innovation and growth.

While past administrations, particularly under President Joe Biden, have introduced more cautious regulatory measures for the cryptocurrency market, often citing concerns about investor protection, fraud, and market manipulation, the prospect of a Trump presidency could signal a shift towards more market-friendly regulations. With the potential for reduced bureaucratic red tape and a more hands-off approach to digital currencies, the stage could be set for cryptocurrencies to flourish in the U.S. on a scale never before seen.

The Global Shift Toward Digital Assets

The bullish sentiment from Binance’s CEO is not isolated to the U.S. alone. Cryptocurrency has already seen massive global adoption, particularly in regions such as Asia, Europe, and Latin America, where digital currencies are increasingly being used for everything from remittances to investment opportunities. As governments around the world look for ways to boost their economies in a post-pandemic world, the appeal of decentralized finance (DeFi) and blockchain-based assets becomes more evident.

In Teng’s view, the next phase of cryptocurrency’s evolution is a transition from speculative trading to a mainstream, everyday financial tool. He believes that one of the catalysts for this will be the development of new blockchain technologies and decentralized applications (dApps) that will make it easier for individuals and businesses to adopt cryptocurrencies as a primary form of payment, investment, or savings.

“Cryptocurrencies are no longer just an asset class for early adopters or the tech-savvy elite,” Teng said. “They’re becoming a part of the broader financial ecosystem. And with clearer regulations and a more robust infrastructure, we will see even greater adoption of digital currencies worldwide.”

Institutional Adoption and the Role of Traditional Finance

A key factor driving Teng’s optimism is the growing involvement of institutional investors in the cryptocurrency space. While digital assets were once the domain of retail investors and tech enthusiasts, the rise of institutional interest—spurred by hedge funds, asset managers, and publicly traded companies—has helped provide a sense of legitimacy to the market. More importantly, this influx of institutional capital is not only increasing the value of cryptocurrencies but also driving the development of better infrastructure and regulatory clarity that will ultimately benefit the entire ecosystem.

One example of institutional interest is the rise of Bitcoin and Ethereum-based exchange-traded funds (ETFs), which have allowed investors to gain exposure to cryptocurrency without having to directly purchase and store digital assets. Traditional financial firms, such as BlackRock, Fidelity, and Grayscale, have also launched cryptocurrency products, further solidifying the integration of digital assets into the broader financial market.

Teng notes that while institutions are still approaching cryptocurrencies cautiously, the momentum is undeniable. The influx of institutional capital is not just a sign of growing confidence in the market but also a signal that cryptocurrencies are gradually becoming more integrated into traditional financial systems.

As Teng explained, “The institutional world has recognized the potential of blockchain technology and cryptocurrencies. Over the past few years, we’ve seen a steady increase in institutional participation, and with more transparent and supportive regulatory frameworks, we expect this trend to continue.”

The U.S. as a Global Leader in Crypto Innovation

Despite the challenges of navigating a complex and sometimes hostile regulatory environment, the U.S. remains a key player in the global cryptocurrency landscape. Binance, which was founded in China but now operates globally, has repeatedly expressed its commitment to working with regulators and policymakers to help shape a constructive future for the industry. Teng, a former executive at the Monetary Authority of Singapore, has been instrumental in building relationships with regulators and encouraging collaboration between the crypto industry and government bodies.

“The U.S. has the potential to be a global leader in cryptocurrency innovation,” Teng said. “But it requires a balanced regulatory framework that fosters growth while protecting consumers. We’ve seen positive moves in this direction in recent years, and with the right leadership, we can achieve the kind of breakthrough that allows the U.S. to maintain its position as a global financial powerhouse in the digital age.”

As countries like China, India, and the European Union take their own steps toward digital currency adoption, the U.S. will need to act decisively to retain its leadership position. Teng sees a future in which the U.S. plays a central role in global blockchain and cryptocurrency developments, not just as a market but as a hub of innovation, regulation, and investment.

The Road Ahead: Challenges and Opportunities

While the outlook for cryptocurrency is undeniably positive, Teng acknowledges that the road ahead is not without its challenges. Regulatory hurdles remain a key concern, particularly in the U.S., where lawmakers have yet to pass comprehensive legislation addressing digital assets. In addition, the volatility of the market—often a source of concern for both retail and institutional investors—means that cryptocurrencies will need to gain a level of stability before they can achieve full mainstream acceptance.

Yet despite these obstacles, Richard Teng remains unwavering in his belief that the cryptocurrency market is on the cusp of an unprecedented transformation. With clearer regulations, growing institutional interest, and increasing mainstream adoption, the “golden age” of cryptocurrency is not just a distant dream—it is rapidly becoming a reality. As the world moves toward a more digital and decentralized future, Binance’s CEO is confident that the cryptocurrency market will continue to evolve, offering new opportunities and reshaping the financial landscape for generations

Binance CEO Richard Teng: Cryptocurrencies Are Entering a “Golden Age” After Trump’s Victory

In the fast-paced and often unpredictable world of cryptocurrency, market predictions are usually met with skepticism. However, when a figure like Richard Teng, CEO of Binance—the world’s largest cryptocurrency exchange by trading volume—makes a bold claim, it’s worth paying attention. Teng recently stated that with Donald Trump’s victory in the U.S. presidential election, cryptocurrencies are poised to enter a “golden age.” The core of this optimism lies not only in Trump’s leadership but also in the potential for the U.S. to enact more favorable, crypto-friendly regulations that will propel the industry to new heights.

A Shifting Regulatory Landscape in the U.S.

For many in the cryptocurrency world, the regulatory environment has been one of the largest roadblocks to the sector’s long-term growth. In the United States, where much of the cryptocurrency market is concentrated, the lack of clear, coherent regulation has left many entrepreneurs and investors uncertain about the future. Past U.S. administrations, particularly under President Biden, have taken a cautious approach to regulating digital currencies, emphasizing investor protection, the prevention of money laundering, and addressing concerns about illicit activities. However, Richard Teng believes that under Trump, who has long supported deregulation and pro-business policies, cryptocurrencies will find a more welcoming environment.

“Trump’s administration has historically been favorable toward market-driven growth and innovation,” Teng said. “If this trend continues, we could see a significant shift in U.S. policies that allow for the free flow of capital and technology in the cryptocurrency space. What crypto needs most right now is clarity, and that’s what I think we will see under a Trump-led government.”

Trump’s stance on cryptocurrencies has been characterized as pragmatic. While he has not expressed unequivocal support for digital assets, his administration’s regulatory approach has tended to favor the advancement of innovative technologies and the economic benefits they bring. This environment, Teng argues, could foster not only greater institutional investment in cryptocurrencies but also the emergence of a regulatory framework that encourages the growth of blockchain technologies without stifling innovation through overreach.

The possibility of a “golden age” for cryptocurrencies, according to Teng, would require the establishment of regulations that are flexible, clear, and forward-thinking. For instance, establishing laws that define what cryptocurrencies are and how they should be taxed would provide businesses with the stability to grow and investors with the confidence to enter the market. It’s not about dismantling protections for investors, but rather ensuring that regulations are not so restrictive that they hinder progress or limit the adoption of emerging technologies.

Global Trends Favoring Digital Assets

Teng’s optimistic vision for cryptocurrency’s future is not confined to the U.S. alone. In fact, the global trend toward digital assets is already well underway, and the United States is, in many ways, playing catch-up. Globally, cryptocurrencies are gaining traction, particularly in emerging markets where access to traditional banking infrastructure is limited. Countries like Brazil, India, and Nigeria are seeing an uptick in cryptocurrency adoption as a tool for everything from remittances to preserving wealth in volatile economic environments.

Europe has also been taking significant steps toward a digital future. The European Union’s Markets in Crypto-Assets (MiCA) regulation aims to create a harmonized framework for the cryptocurrency market across its member states, allowing for smoother cross-border transactions and greater consumer protection. Meanwhile, Asia remains a powerhouse for cryptocurrency adoption, with countries like Japan, South Korea, and Singapore leading the way in blockchain innovation and regulation.

However, despite these global developments, Richard Teng remains confident that the U.S. still holds the potential to lead the world in cryptocurrency innovation. The combination of the country’s large and sophisticated financial markets, cutting-edge technology sector, and influential global financial position gives it a unique opportunity to be at the forefront of the digital asset revolution.

“The U.S. has always been a hub for financial innovation, from the rise of Silicon Valley to the global dominance of the U.S. dollar,” Teng explained. “The next stage of this evolution could very well be the rise of digital currencies, and the U.S. has the infrastructure, expertise, and regulatory influence to lead that charge. The question is, will regulators embrace this opportunity?”

Institutional Interest Is Key

A crucial development that Teng sees as part of this “golden age” is the increasing institutional adoption of cryptocurrencies. A few years ago, the idea of hedge funds, publicly traded companies, or traditional asset managers getting involved in the crypto space seemed like a far-off dream. Today, however, major financial institutions are heavily involved, and this trend is showing no signs of slowing down.

Institutional interest in cryptocurrencies, particularly Bitcoin and Ethereum, has grown significantly in recent years. Companies like MicroStrategy, Tesla, and Block.one have made substantial investments in Bitcoin, while firms like Fidelity, Goldman Sachs, and BlackRock are offering crypto-related products to their clients. The introduction of Bitcoin and Ethereum exchange-traded funds (ETFs) has further solidified the legitimacy of cryptocurrencies as an asset class.

In his statements, Richard Teng acknowledged that institutional players have been cautious, but their increasing involvement is helping to professionalize the space. Institutional investors, who bring with them vast amounts of capital and expertise, are crucial for driving the growth of the digital asset market, not just in terms of financial investment but also in terms of the infrastructure necessary to make crypto markets more accessible, secure, and reliable.

“Institutions are no longer viewing crypto as a speculative gamble but as a legitimate part of the broader financial ecosystem,” Teng said. “This shift is opening up a whole new wave of innovation, from traditional financial products built on blockchain to the development of decentralized finance (DeFi) and tokenized assets.”

The Future of Crypto: Adoption, Stability, and Innovation

Richard Teng’s vision for the future of cryptocurrency goes beyond mere market growth. He predicts a shift in how digital currencies will be used, moving from speculative assets to everyday financial tools. The key to this transformation, he argues, will be the continued development of blockchain technology and decentralized applications (dApps), which will make cryptocurrencies easier to use for everyday transactions, investments, and savings.

For instance, innovations such as stablecoins—cryptocurrencies pegged to a stable asset like the U.S. dollar—could become a common way for people to save or transact, offering the benefits of digital currencies without the volatility typically associated with them. Additionally, the rise of decentralized finance (DeFi) platforms has already begun to change how individuals access loans, earn interest, and engage with financial services without the need for traditional banks.

However, despite these promising developments, the road to full mainstream adoption will not be without obstacles. Regulatory uncertainty, concerns about market volatility, and potential risks associated with crypto’s decentralized nature remain issues that need to be addressed. Richard Teng acknowledges these challenges but remains confident that the right regulatory environment and continued technological advancement will lead to greater stability and adoption over time.

“We are at the beginning of what could be a revolution in how we think about money and finance,” he said. “We are no longer talking about just an asset class—cryptocurrencies are reshaping the entire financial landscape. The golden age is about more than just price increases; it’s about creating an ecosystem where blockchain technology enhances everything from payments to asset management.”

Conclusion: A New Era for Cryptocurrencies

For Richard Teng and many others in the cryptocurrency space, the future is undeniably bright. With supportive regulatory changes, the continued maturation of blockchain technologies, and a growing appetite for institutional and mainstream adoption, cryptocurrencies are poised to enter a new phase of growth. Donald Trump’s victory could play a pivotal role in shaping the regulatory landscape in ways that foster innovation while ensuring that investor protections are in place.

As the global financial system becomes increasingly digital, the United States has the potential to solidify its position as a leader in the cryptocurrency space. If Teng’s vision holds true, the next few years could indeed mark the beginning of a “golden age” for digital assets, one that reshapes the financial ecosystem in ways that were once unimaginable. With a clearer regulatory framework, increasing institutional participation, and the growing adoption of cryptocurrencies by the general public, the future looks promising for a world that is becoming more decentralized, transparent, and efficient.