Updated Fri, Nov 22 20244:46 AM EST

Euro slumps to two-year low after weak PMI data; Europe stocks rise

LONDON — European stocks were higher on Friday, as investors reviewed a range of key regional data points.

The pan-European Stoxx 600 index was trading 0.1% higher at 9:40 a.m. London time, paring some of its earlier gains. Utilities stocks led the gains, up 1.3%, while Europe’s banking index slipped 1.8%.

The regional index snapped a four-session losing streak on Thursday to close around 0.5% higher.

Data published Friday showed the German economy eked out 0.1% growth in the third quarter on the previous three months — lower than a preliminary reading of 0.2% for the period.

In the U.K., the pound fell to a six-month low against the U.S. dollar following U.K. retail sales data. The country’s Office for National Statistics said that retail sales volumes lost 0.7% month-on-month in October, well below economists’ expectations of a 0.3% decline.

Investors are also closely monitoring further escalations in the Russia-Ukraine war.

Gold prices extended gains on Friday and were on course for their best week in a year, amid concerns over the conflict. Spot gold was trading around 1.3% higher at $2,704.8 per ounce at 9:40 a.m. London time.

Asia-Pacific markets mostly rose on Friday, tracking gains on Wall Street that saw the S&P 500 index log gains for a fourth straight day.

U.S. stock futures edged higher overnight, on track to end the week with gains across the three major averages.

9 Min Ago

Euro slumps to two-year low on weak flash PMI data

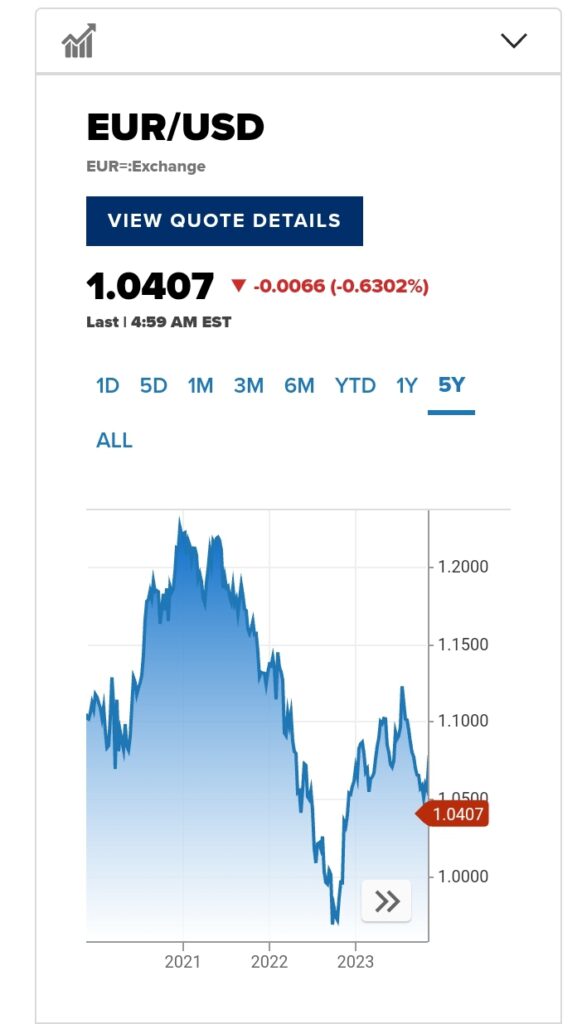

The euro slumped to its lowest level against the dollar in two years on Friday after data showed that euro zone business activity fell sharply in November.

The euro was last seen trading at $1.0399, down 0.7% for the session, after slipping to its lowest level since December 2022.

Euro-dollar over the last five years.

It comes shortly after euro zone business activity was found to have moved back into contraction territory in November.

S&P Global’s HCOB flash composite Purchasing Managers’ Index for the euro zone came in at 48.1 in November, down from 50.0 in October. Analysts polled by Reuters had expected no month-on-month change.

A reading below 50 indicates a contraction, while one above 50 points to expansion.

The reading boosted expectations for a jumbo interest rate cut from the European Central Bank next month.

— Sam Meredith

37 Min Ago

Germany’s business activity falls at quickest rate for nine months

Germany’s business activity fell for the fifth consecutive month and at the fastest pace since February, according to a survey published on Friday.

The S&P Global’s HCOB flash composite Purchasing Managers’ Index came in at 47.3 in November, down from 48.6 in October. Analysts polled by Reuters had expected no month-on-month.

A reading below 50 indicates a contraction, while one above 50 points to expansion.

“Sustained weakness in manufacturing production was compounded by the first decrease in services activity for nine months,” the release from S&P Global said.

“Business expectations meanwhile edged up further from September’s recent low, although confidence was still subdued by historical standards amid a backdrop of economic and political uncertainty,” it added.

— Sam Meredith

1 Hour Ago

Business activity in France contracts at fastest pace since January, PMIs show

Business activity in France shrunk in November, according to S&P Global’s Purchasing Managers’ Index, amid a broad decline in new orders.

The composite PMI output index — which encompasses both services and manufacturing activity — fell to 44.8 in November, down from 48.1 in the previous month and below expectations of 48.3, according to a Reuters poll. The contraction was its fastest since January.

A reading below 50 indicates contraction, while one above 50 indicates expansion.

“Weaker demand was a common theme seen throughout company anecdotal responses during November – both commercial clients and households reportedly lowered their interest in French goods and services – and the latest data showed that new order volumes contracted at the steepest pace in four years,” the release from S&P Global said.

The business executives surveyed also cited negative expectations for activity over the coming year for the first time since May 2020.

— Katrina Bishop

1 Hour Ago

Sweden’s Northvolt files for bankruptcy in the U.S.

Workers walk at the site of the Northvolt Ett factory in Skelleftea, north Sweden on February 23, 2022.

Jonathan Nackstrand | Afp | Getty Images

Swedish battery maker Northvolt filed for Chapter 11 bankruptcy protection in the U.S., reflecting a major setback to Europe’s electrification ambitions.

In a statement published Thursday, Northvolt said the move will allow it to restructure its debt, scale back its business and secure a sustainable foundation for its continued operation.

A partner of major European automakers, Northvolt produces lithium-ion batteries for the blooming electric vehicle industry. In recent months, however, the company has been struggling to stay afloat while navigating a major cost-cutting drive.

— Sam Meredith

1 Hour Ago

Europe markets open firmly in the green

The U.K.’s FTSE 100 index was trading 0.7% higher at 8:20 a.m. London time.

Germany’s DAX was up 0.52%, France’s CAC was 0.49% higher and Italy’s FTSE MIB was up 0.51%.

All sectors were in the green, with tech stocks among the best performers, up 1.1%.

— Katrina Bishop

2 Hours Ago

U.K. retail sales miss indicates a ‘slow start to the golden quarter’

Capital Economics said the U.K.’s disappointing retail sales marked a “slow start to the golden quarter, but the outlook is improving.”

Ashley Webb, U.K. economist, said the decline in sales could be indicative of concerns about tax rises following Finance Minister Rachel Reeves’ tax-and-spend budget.

“But despite those tax rises, we still think a solid rise in real earnings in Q4 will support retail sales volumes in the run up to the crucial festive period,” he wrote in a note on Friday.

October’s fall in spending was relatively broad-based, he added, with clothing stores reporting the biggest slide in retail sales, down 3.1%.

Looking ahead, Ashley said he expects a “chunky” rise in real earnings in the fourth quarter to support retail sales looking ahead.

“Despite the tax rises announced in the Budget, we still expect the retail sector to contribute to above-consensus consumer spending growth of +0.8% in 2024, +1.3% in 2025 and +1.8% in 2026,” he noted.

— Katrina Bishop

2 Hours Ago

Sterling hits six-month low after retail sales slide

The British pound fell to a six-month low against the U.S. dollar following U.K. retail sales data, but has since recouped some losses.

The country’s Office for National Statistics on Friday said that retail sales volumes lost 0.7% month-on-month in October, well below economists’ expectations of a 0.3% decline, according to a Reuters poll. It follows a rise of 0.1% in September.

Sterling fell to around $1.2555 following the data release, its lowest level since the middle of May.

By 7:38 a.m. London time, the pound had pared some losses, trading down 0.16% at $1.2566.

GBP/USD

— Katrina Bishop

2 Hours Ago

German economy ekes out 0.1% growth in third quarter

A electric Ford Explorer is seen as the German Chancellor Olaf Scholz visits the electric car production line at the Ford automobile factory on June 12, 2023 in Cologne, Germany.

Lukas Schulze | Getty Images

The German economy expanded by 0.1% in the third quarter on the previous three months — lower than a preliminary reading of 0.2% for the period.

“In the 2nd quarter, economic performance dropped 0.3%, after having risen slightly (+0.2%) in the 1st quarter. Following this generally subdued performance in the first half of 2024, the German economy begins the second half of the year with modest growth,” the country’s Federal Statistical Office said in a statement.

— Katrina Bishop

9 Hours Ago

CNBC Pro: HSBC names 2 China stock picks for 2025 — and gives one over 70% upside

Chinese markets are “turning a corner” following a series of government stimulus measures, HSBC said, naming its top stock ideas for 2025.

“Mainland China has announced a slew of policies to help ensure that local governments can pay their bills and service debt. This should reduce the risk of an immediate slowdown in growth in mainland China and the market has so far reacted positively to these initiatives,” the investment bank’s analysts wrote in a Nov. 19 research note.

CNBC Pro subscribers can read more here.

— Amala Balakrishner

3 Hours Ago

European markets: Here are the opening calls

European markets are expected to open higher on Friday.

The U.K.’s FTSE 100 index is expected to open 33 points higher at 8,184, Germany’s DAX up 28 points at 19,174, France’s CAC up 5 points at 7,221 and Italy’s FTSE MIB up 52 points at 33,402, according to data from IG.

— Sam Meredith

great articlemonperatoto Terpercaya

great articlemonperatoto Terpercaya

great articlesitus toto Terpercaya