Updated Fri, Nov 15 20241:16 PM EST

Dow tumbles 350 points, heads for losing week as rate concerns stall postelection rally: Live updates

Traders work on the New York Stock Exchange floor on Nov. 12, 2024.

Source: NYSE

Stocks tumbled on Friday as the postelection rally fizzled, placing the major averages on track for sharp weekly losses.

The Dow Jones Industrial Average lost 333 points, or nearly 0.7%. S&P 500 slipped about 1.3%, while Nasdaq Composite shed 2.3%.

Declines in pharmaceutical stocks weighed on the 30-stock Dow and the S&P 500, with Amgen down 5% and Moderna off by 6%. President-elect Donald Trump said on Thursday that he planned to nominate vaccine skeptic Robert F. Kennedy Jr. to lead the U.S. Department of Health and Human Services. The SPDR S&P Biotech ETF (XBI) tumbled more than 4% and headed for its worst week since 2020.

The information technology sector of the S&P 500 was the worst performing corner of the market, down more than 2% as Nvidia, Meta Platforms, Alphabet and Microsoft tumbled more than 2% each. Tesla was a rare exception among its Magnificent Seven peers, as shares of the electric vehicle giant and so-called “Trump Trade” were higher by 3%.

“Investors are catching their breath and evaluating whether the advance has merit,” said Sam Stovall, chief investment strategist at CFRA Research. “We really don’t see anything on the horizon right now to upend stocks, but investors are always sort of looking around to see what could cause the trend to end.”

Traders also grappled with recent comments from Federal Reserve Chairman Jerome Powell, who said on Thursday that the central bank wasn’t “in a hurry” to cut interest rates. He noted that the economy’s strong growth will permit policymakers to take their time as they decide the extent to which they reduce rates. Boston Fed President Susan Collins took the cautious sentiment further, telling The Wall Street Journal that a rate cut next month isn’t a certainty.

October retail sales data on Friday showed a 0.4% increase, slightly better than the 0.3% forecast from economists polled by Dow Jones. That finding follows an October consumer inflation report that was in line with economists’ projections.

The major averages had been coasting on a postelection rally since President-elect Trump’s victory at the polls — the three indexes touched fresh highs on Monday — but the upward momentum has been slowing. The S&P 500 is off about 1.9% week to date, while the Nasdaq Composite is on track for a 2.8% decline. The 30-stock Dow is down more than 1% in the period.

59 Min Ago

Moderna, Super Micro, Alibaba among stocks making biggest midday moves

Check out the companies making headlines in midday trading:

- Global pharma stocks — Shares of several vaccine makers declined after President-elect Donald Trump selected prominent vaccine skeptic Robert F. Kennedy Jr. as health secretary on Thursday. Shares of Moderna and Pfizer slipped nearly 9% and 5%, respectively. BioNTech, which helped develop a Covid vaccine with Pfizer, shed 5%, while GSK declined about 2%. Even names such as Eli Lilly and Novo Nordisk were lower, with both stocks slipping about 4%, amid concerns that the drug approval process could be slowed.

- Super Micro Computer — Shares of the embattled server company fell 2% ahead of a Monday deadline that could result in the company being delisted from the Nasdaq. Super Micro is late on filing a year-end report with the U.S. Securities and Exchange Commission, putting it on the wrong side of the Nasdaq’s rules. This would be the 11th losing day in the last 13 trading sessions for Super Micro.

- Alibaba — Shares slipped more than 2% after the Chinese e-commerce giant’s fiscal second-quarter sales fell short of estimates amid a weakening consumer backdrop in China. Alibaba’s revenue of 236.5 billion yuan came out 5% higher year on year but below analysts’ expectations of 238.9 billion yuan, per LSEG.

For the full list, read here.

— Pia Singh

2 Hours Ago

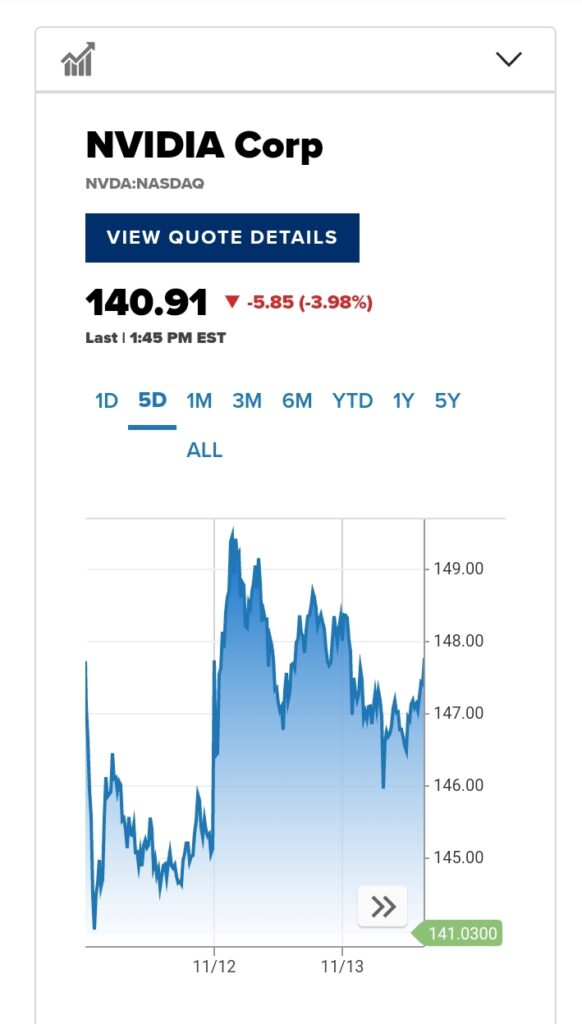

Nvidia falls, heads for losing week as member of the Dow

Nvidia fell more than 2% on Friday, continuing a rough start to the chip giant’s tenure as a member of the Dow Jones Industrial Average.

The stock was officially added to the 30-stock blue chip average before trading began last Friday. Nvidia is now on track for its fourth losing session in six since the addition.

NVIDIA Corp

NVDA:NASDAQ

140.94

Last | 1:45 PM EST

Nvidia stock is on track to be a loser on the week, its first a member of the Dow.

Nvidia was trading just under $143 per share in midday trading, meaning it is down about 4% from when it entered the Dow, and is down about 3% for the week.

— Jesse Pound

2 Hours Ago

Health care leads weekly losses

The health-care sector lost 5.3% on the week, making it the worst-performing group in the S&P 500.

Materials and information technology were the following biggest decliners, falling 3.1% and 2.9%, respectively.

The only sectors on pace to end the week in the green were financials and energy, which were up 1.3% and 0.9%, respectively.

— Hakyung Kim

3 Hours Ago

Chicago Fed’s Goolsbee still sees rates on a downward path

Chicago Federal Reserve President Austan Goolsbee expressed confidence Friday that the central bank is on the way to achieving its economic goals and can continue to lower interest rates.

“To me, the conditions on the dual mandate side are looking pretty balanced,” Goolsbee said during a CNBC “Squawk Box” interview. “So we should be thinking over the next year, year and a half, the rates need to come down.”

However, Goolsbee also endorsed phrasing Thursday by Fed Chair Jerome Powell that the Fed does not need to be in “a hurry” to cut.

“Unless the conditions change, I’m still feeling good about us being on a 12- to 18-month path of getting the rates down to something like neutral,” he said.

— Jeff Cox

4 Hours Ago

Stocks open lower, on pace for losing week

Stocks opened lower on Friday and were on pace to end the week in the red, as the postelection rally failed to recover.

The S&P 500 fell 0.63%, while the Nasdaq Composite slipped 0.98%. The Dow Jones Industrial Average pulled back 113 points, or 0.25%.

— Brian Evans

4 Hours Ago

Alibaba shares rise after company posts 58% year-over-year profit jump

Alibaba shares climbed before the opening bell after the Chinese e-commerce giant beat profit expectations for the quarter that ended Sept. 30. Its sales disappointed, however, reflecting a broader slowdown in the Chinese retail environment and consumer spending.

Alibaba’s net income rose 58% year on year over the quarter, on the back of the performance of its equity investments. Its revenue of 236.5 billion yuan was 5% higher year on year but below analysts’ expectations of 238.9 billion yuan, according to LSEG data.

Philippe Laffont’s Coatue Management and Michael Burry’s Scion Asset Management boosted their stake in Alibaba significantly, according to recent regulatory filings.

Alibaba shares are up 16.9% this year.

— Pia Singh

5 Hours Ago

Retail sales rose in October; import prices up, New York manufacturing surges

Shoppers carry Ross and Levi’s bags on Post Street in San Francisco on Nov. 13, 2024.

David Paul Morris | Bloomberg | Getty Images

Consumer spending held up in October, though some of the details suggested weakness, according to a Census Bureau report Friday.

Retail sales overall rose 0.4%, down from the upwardly revised 0.8% increase in September but slightly better than the Dow Jones estimate for an increase of 0.3%. However, sales were up just 0.1% excluding autos, compared to a 0.3% forecast, while the “control” group, which excludes several items and feeds directly into GDP calculations, decreased 0.1%.

In other economic news Friday, import prices rose a stronger than expected 0.3% in October. Also, the Empire State Manufacturing Index soared to 31.2, its highest level since December 2021 and far better than the estimate for a flat reading.

— Jeff Cox

6 Hours Ago

Stocks making the biggest moves premarket

Check out the companies making headlines before the bell:

- Applied Materials — Shares tumbled more than 8% after the semiconductor equipment manufacturer offered weak revenue guidance for the current quarter. Applied Materials said it forecasts $7.15 billion in the first fiscal quarter, under the estimate of $7.224 billion from analysts polled by LSEG. The company also reported better-than-expected fiscal fourth-quarter results and provided a strong outlook for adjusted earnings per share.

- Alibaba — Shares jumped more than 3% after the Chinese e-commerce giant beat profit expectations in its fiscal second quarter, although its sales disappointed as the company continues to grapple with weaker consumer spending in China. Alibaba’s net income rose 58% year on year, on the back of its equity investment performance. Its revenue of 236.5 billion yuan came out 5% higher year on year but below analysts’ expectations of 238.9 billion yuan, according to LSEG data.

- Moderna — The biotech company’s shares fell 1.8%, continuing its decline from Thursday following the news that Robert F. Kennedy Jr., a prominent vaccine skeptic, was announced as President-elect Donald Trump’s nominee for secretary of the Department of Health and Human Services.

The full list can be found here.

— Hakyung Kim

6 Hours Ago

Market sees less of a chance of an interest rate cut in December

Market expectations for an interest rate cut in December have eased over the past few days following cautious remarks from Federal Reserve officials.

The odds of a move next month have fallen to 58.7%, according to the CME Group’s FedWatch gauge, which had indicated a probability as high as 82% just a few days ago and was close to 63% earlier Friday morning.

In remarks Thursday, Federal Reserve Chair Jerome Powell said policymakers do not need to rush to ease monetary policy. Boston Fed President Susan Collins told The Wall Street Journal that a cut is not “a done deal,” while Dallas Fed President Lorie Logan also called for caution and Richmond Fed President Thomas Barkin expressed some concern that inflation could prove sticky.

In all, traders now expect the Fed will approve the equivalent of three quarter-percentage-point cuts through the end of 2025, a trend that also has eased in recent days.

— Jeff Cox

6 Hours Ago

Boston Fed president says December rate cut ‘not a done deal’

Federal Reserve Bank of Boston President Susan Collins stands behind the Jackson Lake Lodge in Jackson Hole, where the Kansas City Fed holds its annual economic symposium, in Wyoming on Aug. 24, 2023.

Ann Saphir | Reuters

A December interest rate cut is “certainly on the table, but it’s not a done deal,” Boston Federal Reserve President Susan Collins said in an interview.

Despite market expectations that the central bank will approve its third straight reduction, Collins told The Wall Street Journal that she is still watching the data “and we’ll have to continue to weigh what makes sense.” The Journal said the interview occurred late Thursday.

Markets are assigning about a 62% probability of a quarter-percentage-point reduction, according to the CME Group. That has decreased in recent days as multiple Fed officials have expressed caution about moving too quickly.

Collins will be a voter on the rate-setting Federal Open Market Committee in 2025.

— Jeff Cox

7 Hours Ago

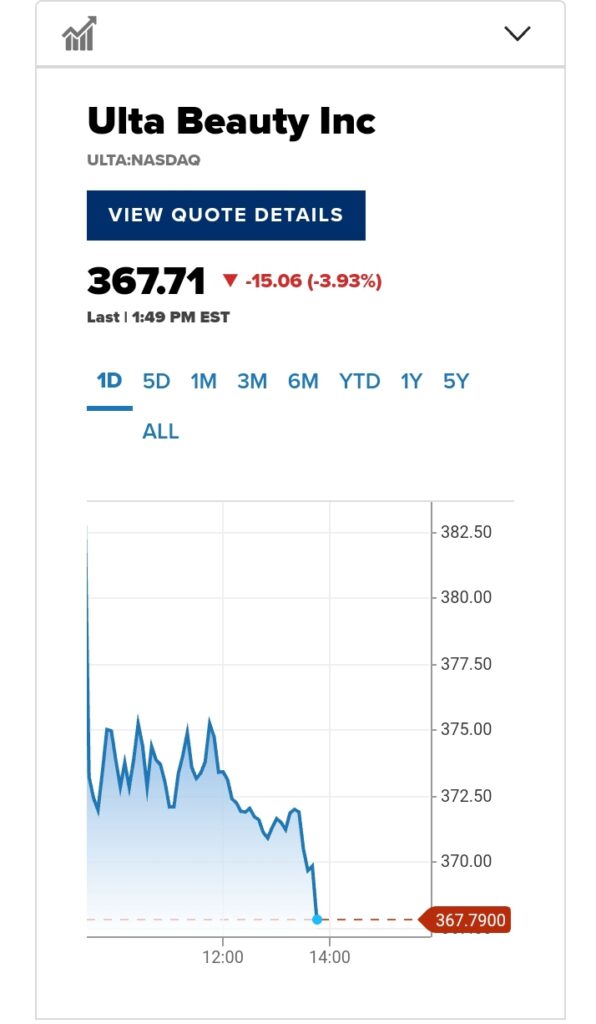

Ulta shares fall in the wake of Berkshire selling shares

Shares of Ulta fell nearly 5% in the premarket on Friday after Warren Buffett’s Berkshire Hathaway revealed it nearly dissolved its stake in the name.

On Thursday, Buffet’s holding company disclosed in a regulatory filing that it sold about 97% of shares last quarter. This comes after the holding company bought the stock in the second quarter.

The stock has had a rough year, with shares plummeting nearly 22%.

Ulta Beauty Inc

ULTA:NASDAQ

369.54

Last | 1:45 PM EST

ULTA, 1-day

— Sean Conlon

7 Hours Ago

Wells Fargo upgrades shares of Morgan Stanley ahead of anticipated inflection point in capital markets

A screen displays the trading information for Morgan Stanley on the floor of the New York Stock Exchange on Jan. 19, 2022.

Brendan McDermid | Reuters

President-elect Donald Trump’s White House victory and a GOP-controlled Congress could lead to more gains for Morgan Stanley, according to Wells Fargo.

The bank upgraded the name to equal weight from underweight, and its updated price target reflects more than 7% upside from Thursday’s close. Meanwhile, the stock has already seen year-to-date gains of around 42%.

“We [estimate] more excess capital than before, [especially] given likely better internal capital generations [with estimated] EPS growth inflecting from negative to positive,” analyst Mike Mayo told clients in a Thursday note. The analyst added that more mergers and IPO activity should spur the inflection in capital markets.

“Indeed, we see a scenario when activity is front-loaded given a 2-year window given the potential for the Senate to flip back,” he continued. “We upgrade MS from U/W to Equal Weight given possible greater than expected short-term tailwinds.”

Anticipating that banks will have more flexibility to return and deploy capital, and that bank mergers will see a “resurgence,” Mayo also upgraded Comerica to equal weight from underweight. That stock has risen more than 25% this year.

— Sean Conlon

11 Hours Ago

European stocks sink at the open

European markets opened lower Friday, as investors assessed fresh economic data and the future path for interest rate cuts following hawkish comments from U.S. Federal Reserve Chair Jerome Powell.

The pan-European Stoxx 600 fell 0.8% in early deals, with all major bourses and almost all sectors sinking into the red.

Health-care stocks shed 1.72%, tracking wider falls for global vaccine makers, as investors weighed President-elect Donald Trump’s nomination of Robert F. Kennedy Jr. to lead the Department of Health and Human Services.

Tech stocks also fell 1.36%, while utilities were a sole outlier, up 0.06%.

— Karen Gilchrist

11 Hours Ago

Asia markets mixed as investors assess Japan and China economic data

Markets in Asia were mixed on Friday, as investors in the region assessed key economic data out of China and Japan.

China released October numbers for retail sales, industrial production and urban unemployment, among others, while Japan’s third-quarter gross domestic product was also announced.

Japan’s Nikkei 225 was up 0.28% after the GDP announcement, while the broad-based Topix rose 0.39%.

Hong Kong’s Hang Seng index rose 0.18% as of its final hour, while mainland China’s CSI 300 fell 1.75% after the data release to 3,968.83.

The yen strengthened marginally against the U.S. dollar to 156.19, after initially weakening after the GDP release.

— Lim Hui Jie

19 Hours Ago

Major averages on track for weekly losses

With just Friday left in the trading week, the three major indexes are on track to end in the red.

The Nasdaq Composite has led the way down with a 0.9% slide this week. The S&P 500 and Dow have shed 0.8% and 0.5%, respectively.

— Alex Harring

19 Hours Ago

BlackRock’s Rick Rieder believes Fed should cut rates one more time in December

Rick Rieder, BlackRock’s senior managing director, speaking at the Delivering Alpha conference in New York City on Sept. 28, 2023.

Adam Jeffery | CNBC

The Federal Reserve should cut rates at least one more time in December before stopping to evaluate its path, according to BlackRock bond king Rick Rieder.

The federal funds rate is currently sitting at a target range of between 4.5% and 4.75%, which Rieder said is restrictive for most potential borrowers and homebuyers. Rieder believes the U.S. central bank should reduce this by another quarter-percentage point in December to get it closer to 4%.

“Once you get that rate there, then you can sit back and say okay, what do we need to do from this point going forward?” Rieder said on CNBC’s “Closing Bell” on Thursday. “I still think they would like to get at least a couple of cuts done into next year, but the pace at which that happens and whether they actually need it gets really called into question.”

— Lisa Kailai Han

20 Hours Ago

See the stocks moving in extended trading

These are some of the stocks moving after the bell:

- Domino’s Pizza — Shares surged more than 7% after Berkshire Hathaway announced a new stake in the pizza chain.

- Applied Materials — The semiconductor equipment manufacturer slid more than 5% after posting a weaker-than-anticipated revenue outlook for the current quarter.

- Palantir Technologies — The defense tech company added nearly 4% after announcing it will transfer its stock exchange listing from the New York Stock Exchange to the Nasdaq.

— Alex Harring

Dow, S&P 500 futures are near flat

Dow and S&P 500 futures were little changed shortly after 6 p.m. ET.

Both slipped around 0.1%. Meanwhile, Nasdaq 100 futures ticked lower by 0.2%.

— Alex Harring